Seagate 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

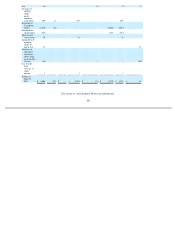

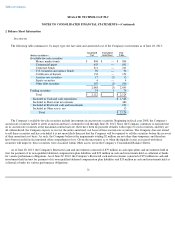

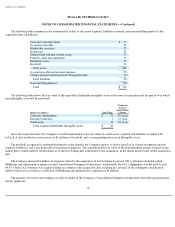

The following table summarizes the estimated fair values of the assets acquired, liabilities assumed, and noncontrolling interest at the

acquisition date (in millions):

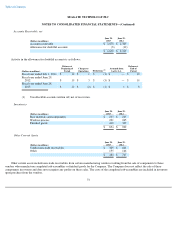

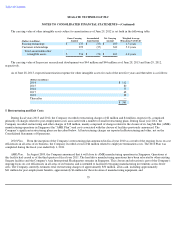

The following table shows the fair value of the separately identifiable intangible assets at the time of acquisition and the period over which

each intangible asset will be amortized:

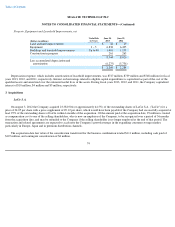

Since the acquisition date, the Company recorded adjustments to the fair value of certain assets acquired and liabilities assumed with

LaCie S.A. that resulted in a net increase of $1 million to Goodwill, and a corresponding decrease in Intangible assets.

The goodwill recognized is attributable primarily to the benefits the Company expects to derive from LaCie's brand recognition and the

acquired workforce, and is not deductible for income tax purposes. The acquisition date fair value of the noncontrolling interest is based on the

market price of their publicly traded shares as of the first trading date subsequent to the acquisition, as the shares did not trade on the acquisition

date.

The Company incurred $1 million of expenses related to the acquisition of LaCie during fiscal year 2013, which are included within

Marketing and administrative expense on the Consolidated Statement of Operations. Additionally, the €0.12 supplement was not paid as only

94.5% of the LaCie business was acquired within six months of the acquisition date, resulting in a reversal of the contingent consideration

liability which was recorded as a reduction of Marketing and administrative expenses of $4 million.

The amounts of revenue and earnings of LaCie included in the Company's Consolidated Statement of Operations from the acquisition date

are not significant.

75

Cash and cash equivalents

$

71

Accounts receivable

29

Marketable securities

27

Inventories

46

Other current and non

-

current assets

19

Property, plant and equipment

12

Intangible assets

45

Goodwill

13

Total assets

262

Accounts payable and accrued expenses

(73

)

Current and non

-

current portion of long

-

term debt

(6

)

Total liabilities

(79

)

Noncontrolling interest

(72

)

Total

$

111

(Dollars in millions)

Fair Value

Weighted

-

Average

Amortization

Period

Customer relationships

$

31

5.0 years

Existing technology

1

5.0 years

Trade name

13

5.0 years

Total acquired identifiable intangible assets

$

45