Seagate 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Seagate Technology plc Stock Purchase Plan (the "ESPP").

There are 50 million ordinary shares authorized to be issued under the ESPP.

In no event shall the total number of shares issued under the ESPP exceed 75 million ordinary shares. The ESPP consists of a six-month offering

period with a maximum issuance of 1.5 million ordinary shares per offering period. The ESPP permits eligible employees to purchase ordinary

shares through payroll deductions generally at 85% of the fair market value of the ordinary shares. As of June 28, 2013 there were approximately

12 million ordinary shares available for issuance under the ESPP.

i365, Inc. 2010 Equity Incentive Plan (the "i365 Plan").

In October 2010, i365, Inc. ("i365"), a wholly owned subsidiary of the Company,

adopted the i365, Inc. 2010 Equity Incentive Plan (the "i365 Plan"). A maximum of 5 million shares of i365's common stock are issuable under

the i365 Plan. Options granted to employees generally vest as follows: 25% of the options on the first anniversary of the vesting commencement

date and the remaining 75% proportionately each month over the next 36 months. Options expire ten years from the date of grant. The

compensation expense associated with options granted to date under the i365 Plan is not material for fiscal year 2013 or 2012.

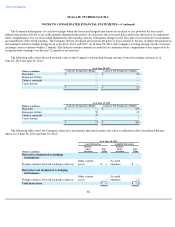

Equity Awards

Full-Value Share Awards (e.g. restricted share units) generally vest over a period of three to four years, with cliff vesting of a portion of

each award occurring annually. Options generally vest as follows: 25% of the options will vest on the first anniversary of the vesting

commencement date and the remaining 75% will vest ratably each month thereafter over the next 36 months. Options granted under the EIP and

SCP have an exercise price equal to the closing price of the Company's ordinary shares on date of grant.

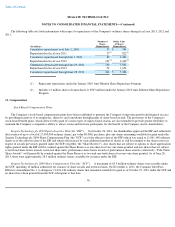

The Company granted performance awards to its senior executive officers under the SCP and the EIP where vesting is subject to both the

continued employment of the participant by the Company and the achievement of certain performance goals established by the Compensation

Committee of the Company's Board of Directors, including market based performance goals. A single award represents the right to receive a

single ordinary share of the Company. During fiscal year 2013, 2012 and 2011, the Company granted 0.7 million, 0.6 million and 0.3 million

performance awards, respectively, where performance is measured based on a three-year average return on invested capital (ROIC) goal and a

relative total shareholder return (TSR) goal, which is based on the Company's ordinary shares measured against a benchmark TSR of a peer

group over the same three-year period (the "TSR/ROIC" awards). These awards vest after the end of the performance period of 3 years from the

grant date. A percentage of these units may vest only if at least the minimum ROIC goal is met regardless of whether the TSR goal is met. The

number of stock units to vest will range from 0% to 200% of the targeted units. In evaluating the fair value of these units, the Company used a

Monte Carlo simulation on the grant date, taking the market-based TSR goal into consideration. Compensation expense related to these units is

only recorded in a period if it is probable that the ROIC goal will be met, and it is to be recorded at the expected level of achievement.

The Company also granted 0.3 million, 0.6 million and 0.2 million performance awards during fiscal years 2013, 2012 and 2011

respectively, to its senior executive officers which are subject to a performance goal related to the Company's adjusted earnings per share (the

"AEPS" awards). These awards have a maximum seven-year vesting period, with 25% annual vesting starting on the first anniversary of the

grant date. If the performance goal is not achieved, vesting is delayed to a following year in which the AEPS goal is achieved. Any unvested

awards from prior years may vest cumulatively in a future year within the seven-year vesting period if the annual AEPS goal is achieved during

a subsequent year. If the AEPS goal has not been met by the end of the seven year period, any unvested shares will be forfeited.

97