Seagate 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

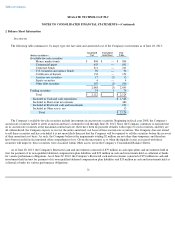

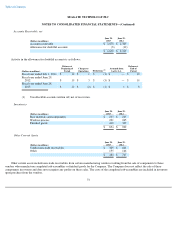

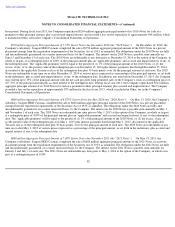

The following table shows the fair value of the separately identifiable intangible assets at the time of acquisition and the period over which

each intangible asset will be amortized:

During fiscal year 2012, the Company recorded adjustments to the fair value of certain assets acquired and liabilities assumed with the

Samsung HDD business that resulted in a net decrease of $5 million to goodwill. These adjustments included a $7 million increase in other

assets for spare parts and a $3 million increase to equipment, offset by a $3 million increase in warranty liability and a $2 million increase in

other liabilities related to certain assumed vendor obligations. These adjustments were based on information about facts and circumstances that

existed at the acquisition date.

The $432 million of goodwill recognized is attributable primarily to the benefits the Company expects to derive from enhanced scale and

efficiency to better serve its markets and expanded customer presence in China and Southeast Asia. Except for approximately $4 million of

goodwill relating to assembled workforce in Korea, none of the goodwill is expected to be deductible for income tax purposes.

The Company incurred a total of $22 million of expenses related to the acquisition of Samsung in fiscal year 2012, which are included

within Marketing and administrative expense on the Consolidated Statement of Operations.

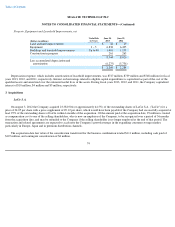

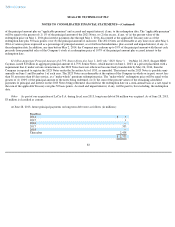

The amounts of revenue and earnings of the acquired assets of Samsung's HDD business included in the Company's Consolidated Statement

of Operations from the acquisition date to the period ended June 29, 2012, were as follows:

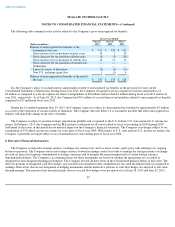

The unaudited pro forma financial results presented below for fiscal years ended June 29, 2012 and July 1, 2011, include the effects of pro

forma adjustments as if the acquisition date occurred as of the beginning of the prior fiscal year on July 3, 2010. The pro forma results combine

the historical results of the Company for the fiscal years ended June 29, 2012 and July 1, 2011, respectively, and the historical results of the

acquired assets and liabilities of Samsung's HDD business, and include the effects of certain fair value adjustments and the elimination of certain

activities excluded from the transaction. The pro forma financial information is presented for informational purposes only and is not necessarily

indicative

77

(Dollars in millions)

Fair Value

Weighted

-

Average

Amortization

Period

Existing technology

$

137

2.0 years

Customer relationships

399

5.8 years

Total amortizable intangible assets acquired

536

4.8 years

In

-

process research and development

44

Total acquired identifiable intangible assets

$

580

(Dollars in millions)

Revenue

$

970

Net income

$

104