Seagate 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

This cost is being amortized on a straight-line basis over a weighted-average remaining term of 2.9 years and will be adjusted for subsequent

changes in estimated forfeitures. The aggregate fair value of nonvested awards vested during fiscal year 2013 was approximately $40 million.

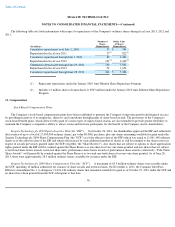

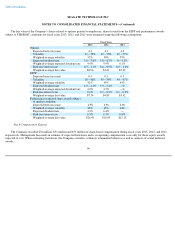

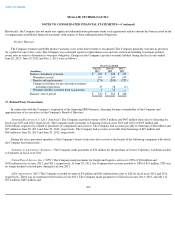

Performance Awards

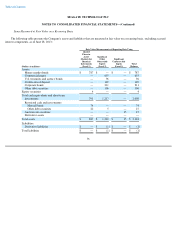

The following is a summary of nonvested award activities which contain a performance condition:

At June 28, 2013, the total compensation cost related to performance awards granted to employees but not yet recognized was

approximately $39 million. This cost is being amortized on a straight-line basis over a weighted-average remaining term of 2.8 years.

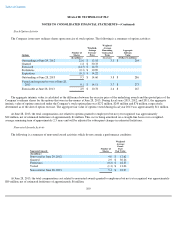

ESPP

During fiscal years 2013, 2012 and 2011, the aggregate intrinsic value of shares purchased under the Company's ESPP was approximately

$17 million, $17 million and $7 million respectively. At June 28, 2013, the total compensation cost related to options to purchase the Company's

ordinary shares under the ESPP but not yet recognized was approximately $1 million. This cost will be amortized on a straight-line basis over a

weighted-average period of approximately one month. During fiscal year 2013, the Company issued 2.0 million ordinary shares with a weighted-

average purchase price of $23.63 per share.

Tax-Deferred Savings Plan

The Company has a tax-deferred savings plan, the Seagate 401(k) Plan (the "40l(k) plan"), for the benefit of qualified employees. The 40l

(k) plan is designed to provide employees with an accumulation of funds at retirement. Qualified employees may elect to make contributions to

the 401(k) plan on a bi-weekly basis. Pursuant to the 401(k) plan, the Company matches 50% of employee contributions, up to 6% of

compensation, subject to maximum annual contributions of $4,500 per participating employee. During fiscal years 2013, 2012, and 2011, the

Company made matching contributions of $14 million, $13 million and $13 million, respectively.

Deferred Compensation Plan

On January 1, 2001, the Company adopted the SDCP for the benefit of eligible employees. This plan is designed to permit certain

discretionary employer contributions, in excess of the tax limits applicable to the 401(k) plan and to permit employee deferrals in excess of

certain tax limits. The Company's assets designated to pay benefits under the plan are held by a rabbi trust. The assets and liabilities of a rabbi

trust are accounted for as assets and liabilities of the Company. As of June 28, 2013 and June 29, 2012, the assets held in the rabbi trust were

approximately $79 million and $73 million, respectively, and are included

101

Performance Awards

Number of

Shares

Weighted

-

Average

Grant-

Date

Fair Value

(In millions)

Performance awards at June 29, 2012

1.7

$

10.69

Granted

1.2

$

27.42

Forfeitures

—

$

—

Vested

(0.3

)

$

11.25

Performance awards at June 28, 2013

2.6

$

18.44