Seagate 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

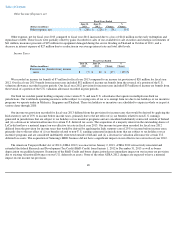

As of June 28, 2013, we had a liability for unrecognized tax benefits and an accrual for the payment of related interest totaling $87 million,

none of which is expected to be settled within one year. Outside of one year, we are unable to make a reasonably reliable estimate of when cash

settlement with a taxing authority will occur.

Off-Balance Sheet Arrangements

As of June 28, 2013, we did not have any material off-balance sheet arrangements (as defined in Item 303(a)(4)(ii) of Regulation S-K).

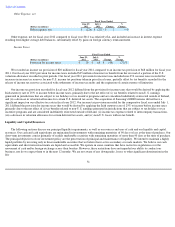

Critical Accounting Policies

The methods, estimates and judgments we use in applying our most critical accounting policies have a significant impact on the results we

report in our consolidated financial statements. The SEC has defined the most critical accounting policies as the ones that are most important to

the portrayal of our financial condition and operating results, and require us to make our most difficult and subjective judgments, often as a

result of the need to make estimates of matters that are highly uncertain at the time of estimation. Based on this definition, our most critical

policies include: establishment of sales program accruals, establishment of warranty accruals, accounting for income taxes, and the accounting

for goodwill and other long-

lived assets. Below, we discuss these policies further, as well as the estimates and judgments involved. We also have

other accounting policies and accounting estimates relating to uncollectible customer accounts, valuation of inventory, valuation of share-based

payments and restructuring. We believe that these other accounting policies and accounting estimates either do not generally require us to make

estimates and judgments that are as difficult or as subjective, or it is less likely that they would have a material impact on our reported results of

operations for a given period.

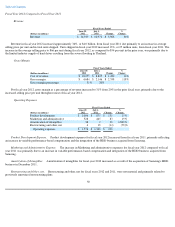

Establishment of Sales Program Accruals. We establish certain distributor and OEM sales programs aimed at increasing customer

demand. For OEM sales, rebates are typically based on an OEM customer's volume of purchases or other agreed upon rebate programs. For the

distribution channel, these programs typically involve rebates related to a distributor's level of sales, order size, advertising or point of sale

activity and price protection adjustments. We provide for these obligations at the time that revenue is recorded based on estimated requirements.

We estimate these contra-revenue rebates and adjustments based on various factors, including price reductions during the period reported,

estimated future price erosion, customer orders, distributor sell-through and inventory levels, program participation, customer claim submittals

and sales returns. Our estimates reflect contractual arrangements but also our judgment relating to variables such as customer claim rates and

attainment of program goals, and inventory and sell-

through levels reported by our distribution customers. Currently, our distributors' inventories

are at the low end of the historical range.

While we believe we have sufficient experience and knowledge of the market and customer buying patterns to reasonably estimate such

rebates and adjustments, actual market conditions or customer behavior could differ from our expectations. As a result, actual payments under

these programs, which may spread over several months after the related sale, may vary from the amount accrued. Accordingly, revenues and

margins in the period in which the adjustment occurs may be affected.

Significant actual variations in any of the factors upon which we base our contra-revenue estimates could have a material effect on our

operating results. In fiscal year 2013, sales programs were approximately 9% of gross revenue. For fiscal years 2012 and 2011, total sales

programs ranged from 2% to 9% of gross revenues. Adjustments to revenues due to under or over accruals for sales programs related to revenues

reported in prior quarterly periods averaged 0.3% of quarterly gross revenue for fiscal years 2011 through 2012, and were approximately 0.3% of

gross revenue in fiscal year 2013. Any future shifts in the

56

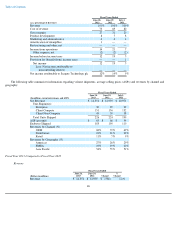

(2) Purchase obligations are defined as contractual obligations for the purchase of goods or services, which are enforceable

and legally binding on us, and that specify all significant terms.