Seagate 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

15. Commitments

Leases. The Company leases certain property, facilities and equipment under non-cancelable lease agreements. Land and facility leases

expire at various dates through 2067 and contain various provisions for rental adjustments including, in certain cases, a provision based on

increases in the Consumer Price Index. Also, certain leases provide for renewal of the lease at the Company's option at expiration of the lease.

All of the leases require the Company to pay property taxes, insurance and normal maintenance costs.

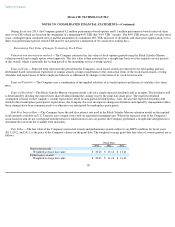

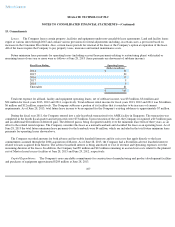

Future minimum lease payments for operating leases (including accrued lease payments relating to restructuring plans) with initial or

remaining terms of one year or more were as follows at June 28, 2013 (lease payments are shown net of sublease income):

Total rent expense for all land, facility and equipment operating leases, net of sublease income, was $35 million, $34 million and

$24 million for fiscal years 2013, 2012 and 2011, respectively. Total sublease rental income for fiscal years 2013, 2012 and 2011 was $4 million,

$6 million and $12 million, respectively. The Company subleases a portion of its facilities that it considers to be in excess of current

requirements. As of June 28, 2013, total future lease income to be recognized for the Company's existing subleases is approximately $7 million.

During the fiscal year 2011, the Company entered into a sale-leaseback transaction for its AMK facility in Singapore. The transaction was

completed in the fourth fiscal quarter and net proceeds were $73 million. Upon execution of the sale, the Company recognized a $15 million gain

and an additional $26 million of deferred gain. The deferred gain is being recognized ratably over the minimum lease term of three years, as an

offset to the related rental expense. The Company considers this lease as a normal leaseback and classified the lease as an operating lease. As of

June 28, 2013 the total future minimum lease payments for the leaseback were $4 million, which are included in the total future minimum lease

payments for operating leases shown above.

The Company recorded amounts for both adverse and favorable leasehold interests and for exit costs that apply directly to the lease

commitments assumed through the 2006 acquisition of Maxtor. As of June 28, 2013, the Company had a $6 million adverse leasehold interest

related to leases acquired from Maxtor. The adverse leasehold interest is being amortized to Cost of revenue and Operating expenses over the

remaining duration of the leases. In addition, the Company had $9 million and $12 million remaining in accrued exit costs related to the planned

exit of Maxtor leased excess facilities at June 28, 2013 and June 29, 2012, respectively.

Capital Expenditures. The Company's non-

cancelable commitments for construction of manufacturing and product development facilities

and purchases of equipment approximated $284 million at June 28, 2013.

107

Fiscal Years Ending

Operating Leases

(Dollars in millions)

2014

$

31

2015

20

2016

15

2017

9

2018

9

Thereafter

81

$

165