Seagate 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Financial instruments that potentially subject the Company to concentrations of credit risk consist primarily of cash equivalents, short-term

investments and foreign currency forward exchange contracts. The Company further mitigates concentrations of credit risk in its investments

through diversification, by limiting its investments in the debt securities of a single issuer, and investing in highly rated securities.

In entering into foreign currency forward exchange contracts, the Company assumes the risk that might arise from the possible inability of

counterparties to meet the terms of their contracts. The counterparties to these contracts are major multinational commercial banks, and the

Company has not incurred and does not expect any losses as a result of counterparty defaults.

Supplier Concentration. Certain of the raw materials, components and equipment used by the Company in the manufacture of its

products are available from a sole supplier or a limited number of suppliers. Shortages could occur in these essential materials and components

due to an interruption of supply or increased demand in the industry. If the Company were unable to procure certain materials, components or

equipment at acceptable prices, it would be required to reduce its manufacturing operations, which could have a material adverse effect on its

results of operations. In addition, the Company has made prepayments to certain suppliers. Should these suppliers be unable to deliver on their

obligations or experience financial difficulty, the Company may not be able to recover these prepayments.

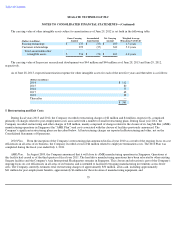

Recent Accounting Pronouncements

In February 2013, the FASB issued ASU No. 2013-02, Comprehensive Income (ASC Topic 220) Reporting of Amounts Reclassified Out of

Accumulated Other Comprehensive Income.

The ASU requires an entity to report information, either on the face of the statement where net

income is presented or in the notes, about the amounts reclassified out of accumulated other comprehensive income by component and to report

significant amounts reclassified out of accumulated other comprehensive income by the respective line items of net income. The ASU is

effective for the Company's first quarter of fiscal year 2014. Other than requiring additional disclosures, the adoption of this new guidance will

not have a material impact on the Company's consolidated financial statements.

In December 2011, the FASB issued ASU No. 2011-11, Balance Sheet (ASC Topic 210)—Disclosures about Offsetting Assets and

Liabilities.

The ASU requires enhanced disclosures on offsetting, including disclosing gross and net information about instruments and

transactions eligible for offset and instruments and transactions subject to an agreement similar to a master netting arrangement. The ASU is

effective for the Company's first quarter of fiscal year 2014 and requires the enhanced disclosures for all comparative periods presented. Other

than requiring additional disclosures, the adoption of this new guidance will not have a material impact on the Company's consolidated financial

statements.

70