Seagate 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

the Company's management believes that it is more likely than not that these deferred tax assets will be realized. The amount of deferred tax

assets considered realizable, however, may increase or decrease in subsequent periods when the Company reevaluates the underlying basis for its

estimates of future U.S. and certain non-U.S. taxable income.

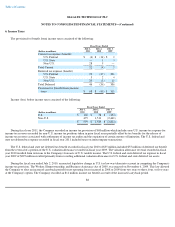

At July 1, 2011, the Company had U.S. federal, state and non-U.S. tax net operating loss carryforwards of approximately $2.6 billion,

$1.8 billion and $623 million, respectively, which will expire at various dates beginning in fiscal year 2013, if not utilized. At July 1, 2011, the

Company had U.S. federal and state tax credit carryforwards of $278 million and $74 million, respectively, which will expire at various dates

beginning in fiscal year 2012, if not utilized. Of the $2.6 billion of loss carryovers noted above, approximately $754 million will be credited to

Additional paid-in capital upon recognition.

Approximately $364 million and $90 million of the Company's U.S. NOL and tax credit carryforwards, respectively, are subject to an

aggregate annual limitation of $45 million pursuant to U.S. tax law.

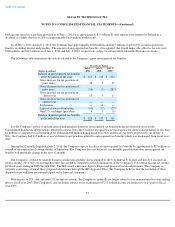

The Company became an Irish tax resident in fiscal year 2010. Prior to fiscal year 2010, the Company was headquartered in the Cayman

Islands and not subject to tax in the Cayman Islands. For purposes of the tax reconciliation between the provision for income taxes at the

statutory rate and the effective tax rate, the Irish statutory rate of 25% was used in fiscal years 2011 and 2010. For fiscal year 2009, a notional

35% statutory rate was used.

A substantial portion of the Company's operations in Malaysia, Singapore, Switzerland and Thailand operate under various tax holidays and

tax incentive programs, which expire in whole or in part at various dates through 2020. Certain of the tax holidays may be extended if specific

conditions are met. The net impact of these tax holidays and tax incentive programs was to increase the Company's net income by approximately

$117 million in fiscal year 2011 ($0.25 per share, diluted), to increase the Company's net income by $307 million in fiscal year 2010 ($0.60 per

share, diluted), and to decrease the Company's net loss by approximately $79 million in fiscal year 2009 ( $ 0.16 per share, diluted).

Since establishing Irish tax residency in fiscal year 2010 as a result of the implementation of certain pre-reorganization steps in connection

with the Company's previously announced plan to move its corporate headquarters to Ireland, the Company consists of an Irish tax resident

parent holding company with various U.S. and non-U.S. subsidiaries that operate in multiple non-Irish taxing jurisdictions. The amount of

temporary differences (including undistributed earnings) related to outside basis differences in the stock of non-Irish resident subsidiaries

considered indefinitely reinvested outside of Ireland for which

90

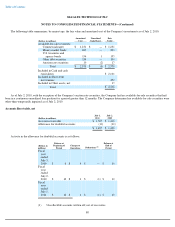

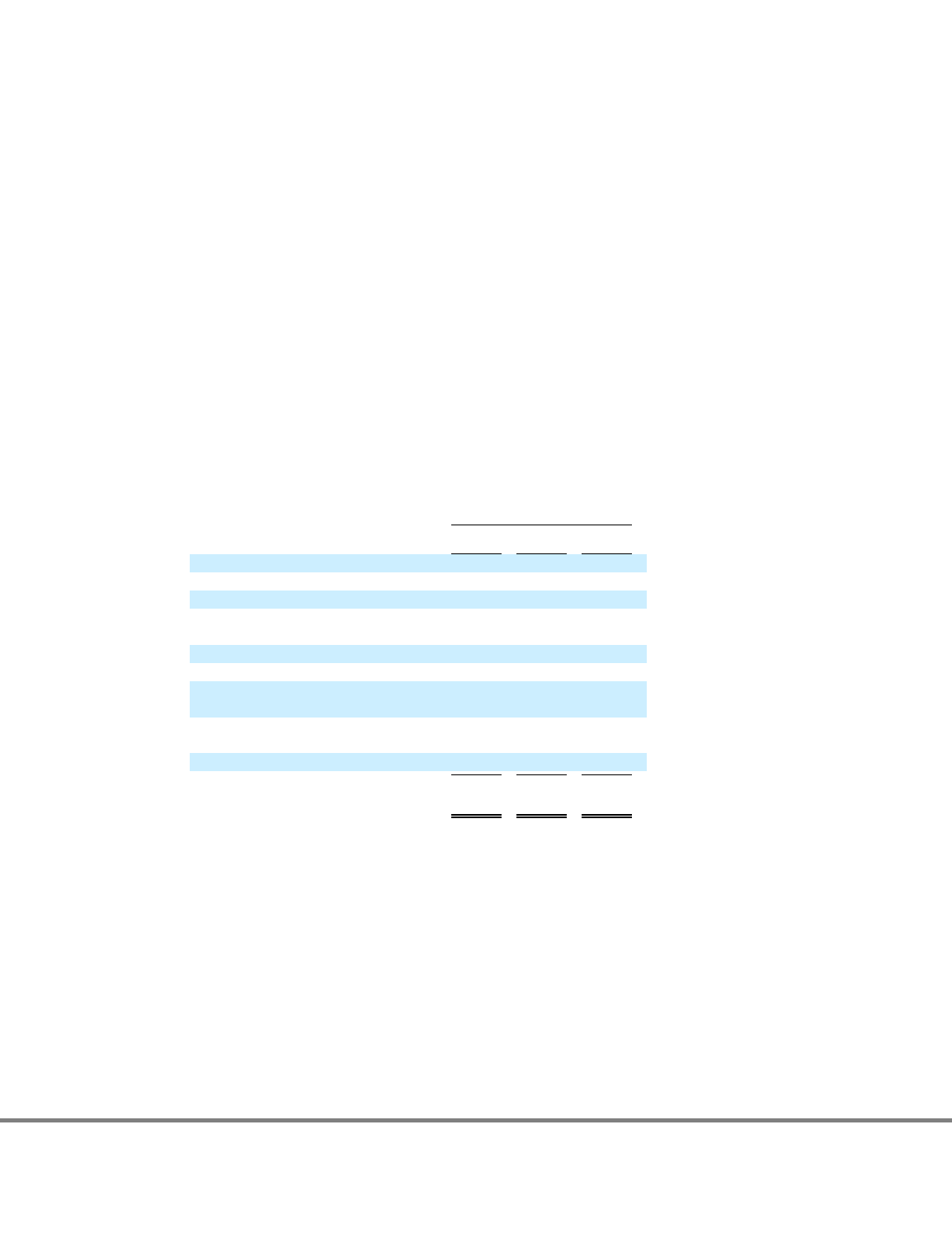

Fiscal Years Ended

(Dollars in millions)

July 1,

2011

July 2,

2010

July 3,

2009

Provision (benefit) at statutory rate

$

145

$

392

$

(985

)

Net U.S. state income tax provision

2

3

6

Permanent differences

—

2

9

Non

-

deductible goodwill

impairments

—

—

813

Valuation allowance

(18

)

(77

)

310

Non

-

U.S. losses with no tax benefits

7

31

263

Non

-U.S. earnings taxed at less than

statutory rate

(102

)

(393

)

(138

)

Tax expense related to intercompany

transactions

26

26

27

Other individually immaterial items

8

(24

)

6

Provision for (benefit from) income

taxes

$

68

$

(40

)

$

311