Seagate 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The adverse leasehold interest is being amortized to Cost of revenue and Operating expenses over the remaining duration of the leases. In

addition, the Company had $16 million and $24 million remaining in accrued exit costs related to the planned exit of Maxtor leased excess

facilities at July 1, 2011 and July 2, 2010, respectively.

Capital Expenditures. The Company's non-cancelable commitments for construction of manufacturing facilities and purchases of

equipment approximated $166 million at July 1, 2011.

15. Guarantees

Indemnifications to Officers and Directors

On May 4, 2009, the Company entered into a new form of indemnification agreement (the "Revised Indemnification Agreement") with its

officers and directors of the Company and its subsidiaries (each, an "Indemnitee"). The Revised Indemnification Agreement provides

indemnification in addition to any of Indemnitee's indemnification rights under the Company's Articles of Association, applicable law or

otherwise, and indemnifies an Indemnitee for certain expenses (including attorneys' fees), judgments, fines and settlement amounts actually and

reasonably incurred by him or her in any action or proceeding, including any action by or in the right of the Company or any of its subsidiaries,

arising out of his or her service as a director, officer, employee or agent of the Company or any of its subsidiaries or of any other entity to which

he or she provides services at the Company's request. However, an Indemnitee shall not be indemnified under the Revised Indemnification

Agreement for (i) any fraud or dishonesty in the performance of Indemnitee's duty to the Company or the applicable subsidiary of the Company

or (ii) Indemnitee's conscious, intentional or willful failure to act honestly, lawfully and in good faith with a view to the best interests of the

Company or the applicable subsidiary of the Company. In addition, the Revised Indemnification Agreement provides that the Company will

advance expenses incurred by an Indemnitee in connection with enforcement of the Revised Indemnification Agreement or with the

investigation, settlement or appeal of any action or proceeding against him or her as to which he or she could be indemnified. The nature of the

indemnification obligations prevents the Company from making a reasonable estimate of the maximum potential amount it could be required to

pay on behalf of its officers and directors. Historically, the Company has not made any significant indemnification payments under such

agreements and no amount has been accrued in the accompanying consolidated financial statements with respect to these indemnification

obligations.

Intellectual Property Indemnification Obligations

The Company has entered into agreements with customers and suppliers that include limited intellectual property indemnification

obligations that are customary in the industry. These guarantees generally require the Company to compensate the other party for certain

damages and costs incurred as a result of third party intellectual property claims arising from these transactions. The nature of the intellectual

property indemnification obligations prevents the Company from making a reasonable estimate of the maximum potential amount it could be

required to pay to its customers and suppliers. Historically, the Company has not made any significant indemnification payments under such

agreements and no amount has been accrued in the accompanying consolidated financial statements with respect to these indemnification

obligations.

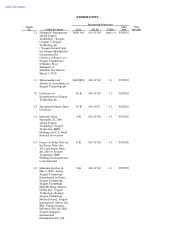

Product Warranty

The Company estimates probable product warranty costs at the time revenue is recognized. The Company generally warrants its products

for a period of one to five years. The Company uses estimated

115