Seagate 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following is a discussion of the financial condition and results of operations for the fiscal years ended July 1, 2011, July 2, 2010, and

July 3, 2009. References to "$" are to United States dollars

.

You should read this discussion in conjunction with "Item 6. Selected Financial Data" and "Item 8. Financial Statements and

Supplementary Data" included elsewhere in this report. Except as noted, references to any fiscal year mean the twelve-month period ending on

the Friday closest to June 30 of that year.

Some of the statements and assumptions included in this Annual Report on Form 10-K are forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933 or Section 21E of the Securities Exchange Act of 1934, each as amended, including, in particular,

statements about our plans, strategies and prospects and estimates of industry growth for the fiscal year ending July 1, 2011 and beyond. These

statements identify prospective information and include words such as "expects," "plans," "anticipates," "believes," "estimates," "predicts,"

"projects," and similar expressions. These forward-looking statements are based on information available to us as of the date of this Annual

Report on Form 10

-K. Current expectations, forecasts and assumptions involve a number of risks, uncertainties and other factors that could

cause actual results to differ materially from those anticipated by these forward-looking statements. Such risks, uncertainties and other factors

may be beyond our control. In particular, the uncertainty in global economic conditions continues to pose a risk to our operating and financial

performance as consumers and businesses may defer purchases in response to tighter credit and negative financial news. Such risks and

uncertainties also include, but are not limited to, the impact of the variable demand and the adverse pricing environment for disk drives,

particularly in view of current business and economic conditions; dependence on our ability to successfully qualify, manufacture and sell our

disk drive products in increasing volumes on a cost-effective basis and with acceptable quality, particularly the new disk drive products with

lower cost structures; the impact of competitive product announcements and possible excess industry supply with respect to particular disk drive

products; our ability to achieve projected cost savings in connection with restructuring plans; and the risk that our recently announced

transaction with Samsung Electronics Co., Ltd. ("Samsung") will not be consummated and the risk that we will incur significant costs in

connection with the transaction (see Pending Transaction with Samsung below). Information concerning risks, uncertainties and other factors

that could cause results to differ materially from those projected in the forward-looking statements is also set forth in "Item 1A. Risk Factors" of

this Annual Report on Form 10-K, which we encourage you to carefully read. These forward-looking statements should not be relied upon as

representing our views as of any subsequent date and we undertake no obligation to update forward-looking statements to reflect events or

circumstances after the date they were made. The following is a discussion of the financial condition and results of operations for the fiscal

years ended July 1, 2011, July 2, 2010, and July 3, 2009.

Our Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is provided in addition to the

accompanying consolidated financial statements and notes to assist readers in understanding our results of operations, financial condition, and

cash flows. MD&A is organized as follows:

• Our Company. Discussion of our business.

•

Business Overview.

Discussion of industry trends and their impact on our business.

•

Fiscal Year 2011 Summary.

Overview of financial and other highlights affecting us for fiscal year 2011.

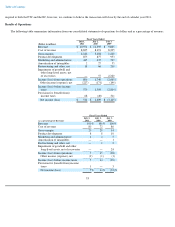

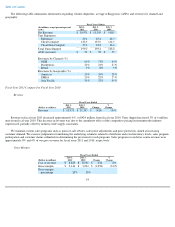

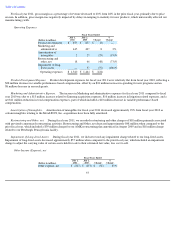

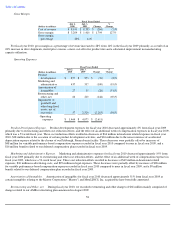

• Results of Operations. Analysis of our financial results comparing 2011 to 2010 and comparing 2010 to 2009.

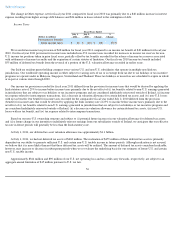

• Liquidity and Capital Resources. An analysis of changes in our balance sheets and cash flows, and discussion of our financial

condition including the credit quality of our investment portfolio and potential sources of liquidity.

48