Seagate 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

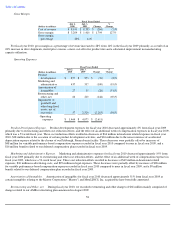

Based on this definition, our most critical policies include: establishment of sales program accruals, establishment of warranty accruals,

accounting for income taxes, and the accounting for goodwill and other long-lived assets. Below, we discuss these policies further, as well as the

estimates and judgments involved. We also have other accounting policies and accounting estimates relating to uncollectible customer accounts,

valuation of inventory, valuation of share-based payments and restructuring. We believe that these other accounting policies and accounting

estimates either do not generally require us to make estimates and judgments that are as difficult or as subjective, or it is less likely that they

would have a material impact on our reported results of operations for a given period.

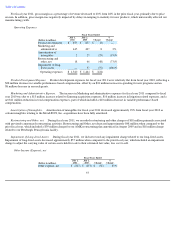

Establishment of Sales Program Accruals. We establish certain distributor and OEM sales programs aimed at increasing customer

demand. For the distribution channel, these programs typically involve rebates related to a distributor's level of sales, order size, advertising or

point of sale activity and price protection adjustments. For OEM sales, rebates are typically based on an OEM customer's volume of purchases or

other agreed upon rebate programs. We provide for these obligations at the time that revenue is recorded based on estimated requirements. We

estimate these contra-revenue rebates and adjustments based on various factors, including price reductions during the period reported, estimated

future price erosion, customer orders, distributor sell-through and inventory levels, program participation, customer claim submittals and sales

returns. Our estimates reflect contractual arrangements but also our judgment relating to variables such as customer claim rates and attainment of

program goals, and inventory and sell-through levels reported by our distribution customers. Currently, our distributors' inventories are at the

low end of the historical range.

While we believe we have sufficient experience and knowledge of the market and customer buying patterns to reasonably estimate such

rebates and adjustments, actual market conditions or customer behavior could differ from our expectations. As a result, actual payments under

these programs, which may spread over several months after the related sale, may vary from the amount accrued. Accordingly, revenues and

margins in the period in which the adjustment occurs may be affected.

Significant actual variations in any of the factors upon which we base our contra-revenue estimates could have a material effect on our

operating results. In fiscal year 2011, sales programs were approximately 8% of gross revenue, reflecting the cumulative effect of the

competitive pricing environment during the first half of fiscal year 2011. For fiscal years 2009 and 2010, total sales programs have ranged from

6% to 12% of gross revenues. Adjustments to revenues due to under or over accruals for sales programs related to revenues reported in prior

quarterly periods have averaged 0.5% of quarterly gross revenue for fiscal years 2009 through 2011, and were approximately 0.4% of quarterly

gross revenue in fiscal year 2011. Any future shifts in the industry supply-demand balance as well as other factors may result in a more

competitive pricing environment and may cause sales programs as a percentage of gross revenue to increase from the current or historical levels.

If such rebates and incentives trend upwards, revenues and margins will be reduced.

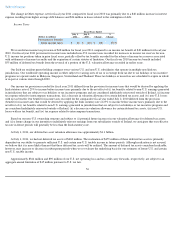

Establishment of Warranty Accruals. We estimate probable product warranty costs at the time revenue is recognized. We generally

warrant our products for a period of one to five years. Our warranty provision considers estimated product failure rates and trends (including the

timing of product returns during the warranty periods), estimated repair or replacement costs and estimated costs for customer compensatory

claims related to product quality issues, if any. We use a statistical model to help with our estimates and we exercise considerable judgment in

determining the underlying estimates. Should actual experience in any future period differ significantly from our estimates, or should the rate of

future product technological advancements fail to keep pace with the past, our future results of operations could be materially affected. Our

judgment is subject to a greater degree of subjectivity with respect to newly introduced products because of limited experience with those

products upon which to base our warranty estimates.

65