Seagate 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

timing of product returns during the warranty periods), estimated repair or replacement costs and estimated costs for customer compensatory

claims related to product quality issues, if any. Should actual experience in any future period differ significantly from its estimates, or should the

rate of future product technological advancements fail to keep pace with the past, the Company's future results of operations could be materially

affected. The Company also exercises judgment in estimating its ability to sell certain repaired disk drives. To the extent such sales vary

significantly from the Company's forecast, warranty cost will be adversely or favorably impacted.

Revenue Recognition, Sales Returns and Allowances, and Sales Incentive Programs.

The Company's revenue recognition policy complies

with ASC Topic 605 (ASC 605), Revenue Recognition . Revenue from sales of products, including sales to distribution customers, is generally

recognized when title and risk of loss has passed to the buyer, which typically occurs upon shipment from the Company or third party warehouse

facilities, persuasive evidence of an arrangement exists, including a fixed or determinable price to the buyer, and when collectability is

reasonably assured. Revenue from sales of products to direct retail customers and to customers in certain indirect retail channels is recognized on

a sell-through basis.

The Company records estimated product returns at the time of shipment. The Company also estimates reductions to revenue for sales

incentive programs, such as price protection, and volume incentives, and records such reductions when revenue is recorded. The Company

establishes certain distributor and OEM sales programs aimed at increasing customer demand. For the distribution channel, these programs

typically involve rebates related to a distributor's level of sales, order size, advertising or point of sale activity and price protection adjustments.

For OEM sales, rebates are typically based on an OEM customer's volume of purchases from Seagate or other agreed upon rebate programs. The

Company provides for these obligations at the time that revenue is recorded based on estimated requirements. Marketing development programs

are either recorded as a reduction to revenue or as an addition to marketing expense depending on the contractual nature of the program.

Shipping and Handling. The Company includes costs related to shipping and handling in Cost of revenue for all periods presented.

Restructuring Costs. The Company records restructuring activities, including costs for one-time termination benefits, in accordance with

ASC Topic 420 (ASC 420), Restructuring . Severance costs accounted for under ASC 420 are recognized when management, having the

appropriate authorization, has committed to a restructuring plan and has communicated those actions to employees. Employee termination

benefits covered by existing benefit arrangements are recorded in accordance with ASC Topic 712, Non-retirement Postemployment Benefits .

These costs are recognized when management has committed to a restructuring plan and the severance costs are probable and estimable.

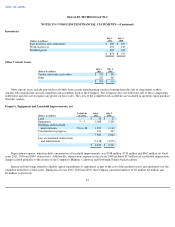

Advertising Expense. The cost of advertising is expensed as incurred. Advertising costs were approximately $21 million, $23 million and

$48 million in fiscal years 2011, 2010 and 2009, respectively.

Stock-Based Compensation. The Company accounts for stock-based compensation under the fair value recognition provisions of ASC

Topic 718 (ASC 718), Compensation-Stock Compensation . The Company has elected to apply the with-and-without method to assess the

realization of excess tax benefits.

Accounting for Income Taxes. The Company accounts for income taxes pursuant to ASC Topic 740 (ASC 740), Incomes Taxes . In

applying ASC 740, the Company makes certain estimates and judgments in determining income tax expense for financial statement purposes.

These estimates and judgments occur in the calculation of tax credits, recognition of income and deductions and calculation of specific tax assets

and liabilities, which arise from differences in the timing of recognition of revenue and expense for tax and

75