Seagate 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

erosion, the existence of rapid product life cycles has necessitated quick achievement of product cost effectiveness. Changing technology also

necessitates on-going investments in research and development, which may be difficult to recover due to rapid product life cycles and economic

declines. Further, there is a continued need to successfully execute product transitions and new product introductions, as factors such as quality,

reliability and manufacturing yields become of increasing competitive importance.

Seasonality

The disk drive industry traditionally experiences seasonal variability in demand with higher levels of demand in the second half of the

calendar year. This seasonality is driven by consumer spending in the back-to-school season from late summer to fall and the traditional holiday

shopping season from fall to winter. In addition, corporate demand is typically higher during the second half of the calendar year. However, with

volatility in fuel costs, the industry may be experiencing higher levels of demand earlier in the calendar year as customers attempt to take

advantage of less expensive modes of transportation, which generally require longer lead times.

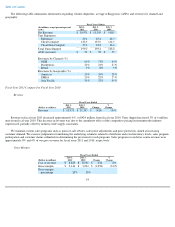

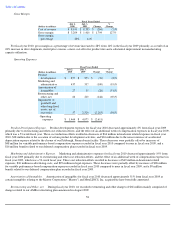

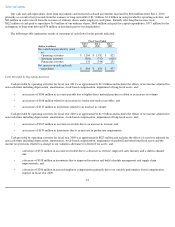

Fiscal Year 2011 Summary

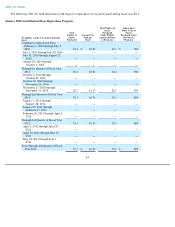

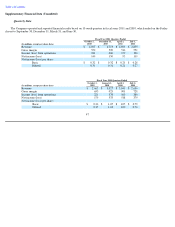

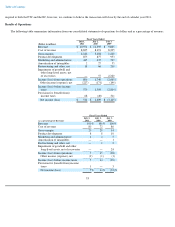

Revenues for fiscal year 2011 were $11.0 billion which represented a 4% decrease in revenues from $11.4 billion in the prior fiscal year.

Gross margin as a percentage of revenue decreased to 20% from 28% in the prior fiscal year. We shipped 199 million units during fiscal year

2011, which represents 3% growth over the prior fiscal year. The decline in revenue reflects the cumulative effect of the competitive pricing

environment the industry experienced during the middle of calendar year 2010, partially offset by an industry-wide supply constraint

experienced in the second half of fiscal year 2011 in what we believed to be a reaction to possible supply chain disruptions stemming from the

earthquake and tsunami in Japan. The decline in gross margin reflects the effects of price erosion as well as the timing in which we were able to

achieve increased manufacturing yields.

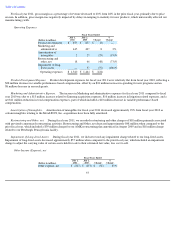

We generated operating cash flow of $1.3 billion, used approximately $822 million to repurchase 56.8 million of our ordinary shares and

used $843 million for capital expenditures. In 2011, we issued $1.3 billion in new long-term debt and we repaid approximately $377 million in

existing long-term debt.

Pending Transaction with Samsung

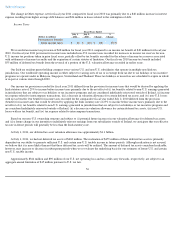

On April 19, 2011, we entered into an Asset Purchase Agreement with Samsung, a company organized under the laws of the Republic of

Korea, pursuant to which we will acquire certain assets and assume certain liabilities of Samsung relating to the research and development,

manufacture and sale of hard-disk drives. Under the terms of the agreement, Samsung will receive consideration comprised of $687.5 million in

cash and approximately 45.2 million of our ordinary shares.

The agreement has no financing contingencies, and is subject to customary closing conditions, including review by U.S. and international

regulators. The agreement contains certain termination rights for Samsung and provides that a specified fee must be paid by us to Samsung in

connection with certain termination events. In certain specified circumstances, we must pay Samsung a termination fee of $72.5 million

(generally if the transaction has not been consummated and the requisite regulatory approvals have not been obtained by the Expiration Date of

December 31, 2011, which may be extended in certain circumstances to March 31, 2012). If regulatory approvals have been obtained but the

transaction has not been consummated by the Expiration Date, then in certain specified circumstances we must pay Samsung a termination fee of

$82.5 million (generally if we are in breach of the agreement and legal remedies are not awarded to Samsung).

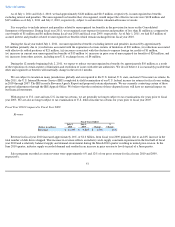

On May 20, 2011, we received a request for additional information from the U.S. Federal Trade Commission (the "FTC") in connection

with the FTC's review of the pending transaction. On May 30, 2011, we received notification from the European Commission (the "EC") that the

EC has decided to seek more information regarding the pending transaction. We are in the process of gathering information to

52