Seagate 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

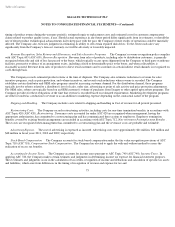

In October 2009, the FASB issued ASU No. 2009-14, Software (ASC Topic 985)—Certain Revenue Arrangements That Include Software

Elements

, a consensus of the FASB Emerging Issues Task Force. This guidance modifies the scope of ASC subtopic 985-605, Software-

Revenue Recognition to exclude from its requirements (a) non-software components of tangible products and (b) software components of

tangible products that are sold, licensed, or leased with tangible products when the software components and non-software components of the

tangible product function together to deliver the tangible product's essential functionality. The Company implemented the provisions of this

guidance beginning on July 3, 2010 on a prospective basis for all new or materially modified arrangements entered into on or after that date. The

adoption of this guidance did not have a material impact on the Company's consolidated financial statements.

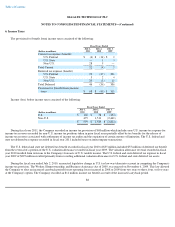

2. Balance Sheet Information

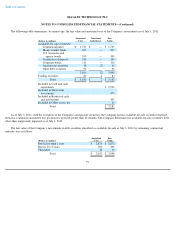

Investments

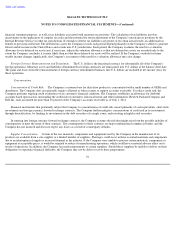

The Company's short-term investments are primarily comprised of readily marketable debt securities with remaining maturities of more

than 90 days at the time of purchase. With the exception of securities held for its non-qualified deferred compensation plan, which are classified

as trading securities, the Company classifies its investment portfolio as available-for-sale. The Company recognizes its available-for-sale

investments at fair value with unrealized gains and losses included in Accumulated other comprehensive income (loss), which is a component of

shareholders' equity. The amortized cost of debt securities is adjusted for amortization of premiums and accretion of discounts to maturity. Such

amortization and accretion are included in interest income. Realized gains and losses are included in Other, net. The cost of securities sold is

based on the specific identification method.

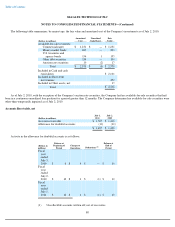

The Company's available-for-sale securities include investments in auction rate securities. Beginning in fiscal year 2008, the Company's

auction rate securities failed to settle at auction and have continued to fail through July 1, 2011. Since the Company continues to earn interest on

its auction rate securities at the maximum contractual rate, there have been no payment defaults with respect to such securities, and they are all

collateralized, the Company expects to recover the entire amortized cost basis of these auction rate securities. The Company does not intend to

sell these securities and has concluded it is not more likely than not that the Company will be required to sell the securities before the recovery of

their amortized cost basis. As such, the Company believes the impairments totaling $2 million are not other-than-temporary and therefore have

been recorded in Accumulated other comprehensive income (loss). Given the uncertainty as to when the liquidity issues associated with these

securities will improve, these securities were classified as long-term investments in the Company's Consolidated Balance Sheets.

As of July 1, 2011, the Company's restricted cash and investments consisted of $84 million in cash and investments held in trust for

payment of its non-qualified deferred compensation plan liabilities and $18 million in cash and investments held as collateral at banks for

various performance obligations. As of July 2, 2010, the Company's restricted cash and investments consisted of $76 million in cash and

investments held in trust for payment of its non-qualified deferred compensation plan liabilities and $38 million in cash and investments held as

collateral at banks for various performance obligations.

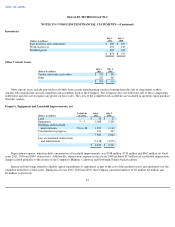

Effective January 3, 2011, the Company cancelled its Total Return Swap (TRS), which had been used to manage the equity market risks

associated with its Non-qualified Deferred Compensation Plan—the Seagate Deferred Compensation Plan (the "SDCP"). Currently, the

Company manages its exposure to equity market risks associated with the deferred compensation liabilities by investing directly in mutual funds

that mirror the employees' investment options. The Company classified investments held to satisfy the deferred compensation liabilities as

trading securities.

78