NVIDIA 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.72

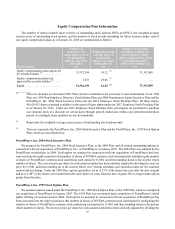

Types of Awards. The terms of the Amended and Restated 2007 Plan provide for the grant of incentive stock options,

nonstatutory stock options, restricted stock awards, restricted stock unit awards, stock appreciation rights, other stock awards,

and performance awards that may be settled in cash, stock, or other property.

Shares Available for Awards. If this Proposal 4 is approved, the total number of shares of our common stock authorized

for issuance under the Amended and Restated 2007 Plan will consist of 187,767,766 shares, or the Share Reserve, which

is the sum of (i) 152,767,766 shares, which is the total reserve that our stockholders approved at our 2007 Annual Meeting

(as adjusted for our September 2007 forward stock split), including, but not limited to, the shares remaining available for

issuance under the Prior Plans and the Returning Shares, (ii) 25,000,000 shares, which is the number of additional shares

that our stockholders approved at our 2012 Annual Meeting (and reapproved at our 2013 Annual Meeting), and (iii)

10,000,000 newly requested shares. The “Returning Shares” are shares subject to awards granted under the Prior Plans that

expire or terminate for any reason prior to exercise or settlement.

If any shares of our common stock subject to awards granted under the Amended and Restated 2007 Plan are not

delivered to a participant because (i) an award is exercised through a reduction in the number of shares subject to the stock

award, or a net exercise, or (ii) shares are reacquired, withheld or not issued to satisfy a tax withholding obligation or if

shares are used as consideration for the exercise of a stock option or stock appreciation right, then those shares will not

remain available for subsequent issuance under the Amended and Restated 2007 Plan.

If a stock award is settled in cash, such settlement will not reduce the Share Reserve. If a stock award expires or

otherwise terminates without having been exercised in full, or if any shares of our common stock issued pursuant to a stock

award are forfeited to or repurchased by us, including because of the failure to meet a contingency or condition required

for the vesting of such shares, then the shares of common stock not issued under such stock award, or forfeited to or

repurchased us, will become available again for issuance under the Amended and Restated 2007 Plan.

Eligibility. All of our approximately 8,847 employees, nine non-employee directors and 443 consultants as of March

25, 2014 are eligible to participate in the Amended and Restated 2007 Plan and may receive all types of awards other than

incentive stock options. Incentive stock options may be granted under the Amended and Restated 2007 Plan only to our

employees (including officers) and employees of our affiliates.

Section 162(m) Limits. Under the Amended and Restated 2007 Plan, subject to adjustment for changes in our

capitalization, no participant will be eligible to be granted during any fiscal year more than: (i) a maximum of 2,000,000

shares of our common stock subject to stock options, stock appreciation rights and other stock awards whose value is

determined by reference to an increase over an exercise price or strike price of at least 100% of the fair market value of our

common stock on the date of grant; (ii) a maximum of 2,000,000 shares of our common stock under performance stock

awards; and (iii) a maximum of $6,000,000 under performance cash awards. If a performance stock award is in the form

of an option, it will count only against the performance stock award limit. If a performance stock award could be paid out

in cash, it will count only against the performance stock award limit. These limits are designed to allow us to grant awards

that are exempt from the $1,000,000 limitation on the income tax deductibility of compensation paid per covered employee

imposed by Section 162(m) of the Code.

Administration. The Amended and Restated 2007 Plan is administered by our Board, which may in turn delegate

authority to administer the Amended and Restated 2007 Plan to a committee. Our Board has delegated concurrent authority

to administer the Amended and Restated 2007 Plan to the Compensation Committee, but may, at any time, revest in itself

some or all of the power previously delegated to the Compensation Committee. Each of the Board and the Compensation

Committee is considered to be a Plan Administrator for purposes of this Proposal 4. Subject to the terms of the Amended

and Restated 2007 Plan, the Plan Administrator may determine the recipients, numbers and types of awards to be granted,

and terms and conditions of the awards, including the period of their exercisability and vesting. Subject to the limitations

set forth below, the Plan Administrator also determines the fair market value applicable to a stock award and the exercise

price of stock options and stock appreciation rights granted under the Amended and Restated 2007 Plan.