NVIDIA 2013 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2013 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

76

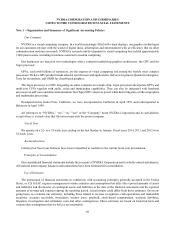

certain laboratories at our Austin facility and international locations to their original condition upon lease termination were

$11.1 million and $10.6 million, respectively.

Adoption of New and Recently Issued Accounting Pronouncements

In July 2013, the Financial Accounting Standards Board, or FASB, issued guidance regarding the presentation of

unrecognized tax benefits when a net operating loss carryforward, similar tax loss, or tax credit carryforward exists. The

new guidance requires that an unrecognized tax benefit, or a portion of an unrecognized tax benefit, be presented in the

financial statements as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax

credit carryforward when settlement in this manner is available under the tax law. This guidance is effective on a prospective

basis for financial statements issued for fiscal years, and interim periods within those fiscal years, beginning after December

15, 2013. Retrospective and early adoption is permitted. We expect to adopt this guidance in our interim and annual periods

beginning January 27, 2014. We do not believe the adoption of this guidance will have a material impact on our consolidated

financial statements.

In February 2013, the FASB issued updated guidance requiring entities to report the effect of significant reclassifications

to accumulated other comprehensive income on the respective line items in net income. These reclassifications are reported

only if U.S. GAAP requires the entire amount to be reclassified to net income. For other amounts that are not required under

U.S. GAAP to be reclassified in their entirety from accumulated other comprehensive income to net income in the same

reporting period, an entity is required to cross-reference other disclosures required under U.S. GAAP that provide additional

detail about those amounts. We adopted this guidance in our interim period ended April 28, 2013. The adoption of this

guidance did not impact our financial statements, as the guidance is related to disclosure only, and we have not had significant

reclassifications out of accumulated other comprehensive income.

Note 2 - Stock-Based Compensation

We measure stock-based compensation expense based on the estimated fair value of equity awards at the grant date,

and recognize the expense using a straight-line attribution method over the requisite employee service period. We estimate

the fair value of employee stock options on the date of grant using a binomial model and we use the closing trading price

of our common stock on the date of grant, minus a dividend yield discount, as the fair value of awards of RSUs. We estimate

the fair value of shares to be issued our employee stock purchase plan using the Black-Scholes at the commencement of an

offering period in March and September each year. Our stock-based compensation for employee stock purchase plan is

expensed using an accelerated amortization model.

Our consolidated statements of income include stock-based compensation expense, net of amounts capitalized as

inventory, as follows:

Year Ended

January 26,

2014 January 27,

2013 January 29,

2012

(In thousands)

Cost of revenue..................................................................................... $ 10,688 $ 10,490 $ 11,322

Research and development ................................................................... 82,940 82,157 80,502

Sales, general and administrative ......................................................... 42,667 44,015 44,530

Total...................................................................................................... $ 136,295 $ 136,662 $ 136,354

As of January 26, 2014 and January 27, 2013, the aggregate amount of unearned stock-based compensation expense

related to our equity awards was $241.3 million and $208.7 million, respectively, adjusted for estimated forfeitures. As of

January 26, 2014 and January 27, 2013, we expect to recognize the unearned stock-based compensation expense related to