NVIDIA 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

Equity Compensation

Our Compensation Committee believes that equity compensation is a critical element of our total compensation package,

and for that reason, equity compensation generally comprises a significant portion of the total target value of the annual

compensation opportunity for each of our executive officers. Equity compensation aligns the long-term interests of

stockholders and employees by creating a strong, direct link between employee compensation and stock price appreciation.

Our Compensation Committee also believes that if our executive officers own shares of our common stock with values that

are significant to them, they will have an incentive to act to maximize longer-term stockholder value instead of short-term

gain. Further, our Compensation Committee believes that equity compensation is an integral component of our efforts to

attract and retain exceptional executives, senior management and employees.

In recent years, we have granted a mix of stock options and RSUs to our executive officers (other than Mr. Huang who

in recent years received only stock options) to motivate long-term value creation through sustained increases in our stock

price for stock options to have meaningful value and to promote retention through balancing the risk associated with our

stock price volatility by granting RSUs. In fiscal year 2014, our Compensation Committee continued our past practice of

granting a mix of stock options and RSUs to our executive officers (except for Mr. Huang and Ms. Kress). For fiscal year

2014, our Compensation Committee decided to shift from granting 100% of Mr. Huang’s annual equity grant in the form

of stock options to a mix of PSUs and stock options to reflect changing market trends for peer CEOs.

Each stock option vests based on continued service over a four-year period, with the first installment vesting after one

year. Once stock options vest, executive officers have the opportunity to acquire shares of our common stock at a fixed

exercise price per share (the closing price of our common stock on the grant date) over a specified period of time. Stock

options provide value to our executive officers only if the market price of our common stock appreciates over the stock

option term and only if the executive officer remains with NVIDIA through each applicable vesting date.

Except for the PSUs granted to Mr. Huang and described below, RSUs generally vest over a four-year period, subject

to the executive officer’s continued service on each applicable vesting date. The value of each RSU increases or decreases

with our stock price. Our Compensation Committee believes that granting RSUs is appropriate for several reasons, including

that it is consistent with the practices at our peer companies, that it provides a useful retention tool and that it helps us

manage dilution.

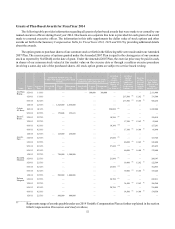

In February and March 2013, our Compensation Committee met to determine equity grant levels for each executive

officer for fiscal year 2014. In determining appropriate award levels, our Compensation Committee reviewed the target

aggregate value of equity compensation for similarly situated executives at the 25th, 50th and 75th percentiles of our peer

companies. The Compensation Committee also considered internal pay equity, dilution management as determined by

reference to our equity budget for the year for the entire Company, the effect of the award size on the total target compensation

opportunity for the year and whether the award size is likely to achieve our performance and retention goals. As noted above

under Factors Used in Determining Executive Compensation, no one single factor was determinative and there was no

formula or specific weighting that was used.

For executive officers (other than Mr. Huang and Ms. Kress), for fiscal year 2014, our Compensation Committee

allocated approximately 60% of the aggregate value of equity compensation to RSUs and 40% to stock options. For fiscal

year 2014, in determining the number of shares needed to achieve the appropriate mix of stock options and RSUs, our

Compensation Committee used a ratio of approximately five stock option shares to three RSU shares, as this was determined

to approximate the relative grant date fair values of the awards (using a Black-Scholes model for purposes of valuing the

stock options).

Once the desired target aggregate value of equity compensation and mix for each executive officer was determined,

our Compensation Committee reviewed our stock price trend to approximate the number of shares each executive officer

would receive in fiscal year 2014. For executive officers (other than Mr. Huang and Ms. Kress as discussed below), our

Compensation Committee then divided the shares in half and granted half of the shares in March 2013 and half of the shares

in September 2013.