NVIDIA 2013 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2013 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

73

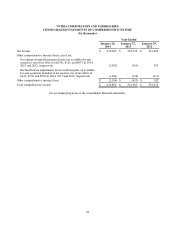

Comprehensive Income

Comprehensive income consists of net income and other comprehensive income (loss). Other comprehensive income

(loss) components include unrealized gains (losses) on available-for-sale securities, net of tax.

Net Income Per Share

Basic net income per share is computed using the weighted average number of common shares outstanding during the

period. Diluted net income per share is computed using the weighted average number of common and potentially dilutive

shares outstanding during the period, using the treasury stock method. Under the treasury stock method, the effect of stock

options outstanding is not included in the computation of diluted net income per share for periods when their effect is anti-

dilutive. Additionally, we issued convertible notes with a net settlement feature that requires us, upon conversion, to settle

the principal amount of debt for cash and the conversion premium for cash or shares of our common stock. Our convertible

notes, note hedges, and related warrants contain various conversion features, which are further described in Note 11 of these

Notes to the Consolidated Financial Statements. The potentially dilutive shares resulting from the convertible notes and

warrants under the treasury stock method will be included in the calculation of diluted income per share when their inclusion

is dilutive. However, unless actually exercised, the note hedges will not be included in the calculation of diluted net income

per share, as their pre-exercised effect would be anti-dilutive under the treasury stock method.

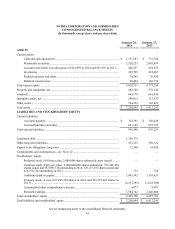

Cash and Cash Equivalents

We consider all highly liquid investments that are readily convertible into cash and have an original maturity of three

months or less at the time of purchase to be cash equivalents. As of January 26, 2014 and January 27, 2013, our cash and

cash equivalents were $1,151.6 million and $732.8 million, respectively, which include $307.9 million and $195.8 million

invested in money market funds for fiscal year 2014 and fiscal year 2013, respectively.

Marketable Securities

Marketable securities consist primarily of highly liquid investments with maturities of greater than three months when

purchased. We generally classify our marketable securities at the date of acquisition as available-for-sale. These securities

are reported at fair value with the related unrealized gains and losses included in accumulated other comprehensive income,

a component of stockholders’ equity, net of tax. Any unrealized losses which are considered to be other-than-temporary

impairments are recorded in the other income and expense section of our consolidated statements of income. Realized gains

and losses on the sale of marketable securities are determined using the specific-identification method and recorded in the

other income and expense section of our consolidated statements of income.

All of our available-for-sale investments are subject to a periodic impairment review. We record a charge to earnings

when a decline in fair value is significantly below cost basis and judged to be other-than-temporary, or have other indicators

of impairments. If the fair value of an available-for-sale debt instrument is less than its amortized cost basis, an other-than-

temporary impairment is triggered in circumstances where (1) we intend to sell the instrument, (2) it is more likely than not

that we will be required to sell the instrument before recovery of its amortized cost basis, or (3) a credit loss exists where

we do not expect to recover the entire amortized cost basis of the instrument. If we intend to sell or it is more likely than

not that we will be required to sell the available-for-sale debt instrument before recovery of its amortized cost basis, we

recognize an other-than-temporary impairment in earnings equal to the entire difference between the debt instruments’

amortized cost basis and its fair value. For available-for-sale debt instruments that are considered other-than-temporarily

impaired due to the existence of a credit loss, if we do not intend to sell and it is not more likely than not that we will be

required to sell the instrument before recovery of its remaining amortized cost basis (amortized cost basis less any current-

period credit loss), we separate the amount of the impairment into the amount that is credit related and the amount due to

all other factors. The credit loss component is recognized in earnings while loss related to all other factors is recorded as

other comprehensive income.