NVIDIA 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

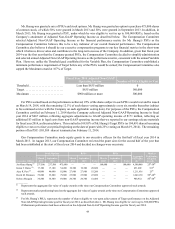

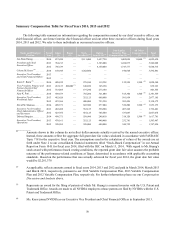

50th and 75th percentiles of our peer companies, with the objective of maintaining, or increasing, as applicable, the total

target cash opportunity for our executive officers so that it is competitive with the total target cash compensation opportunities

at our peer companies. Our Compensation Committee did not use a formula or assign a particular weight to any one factor

in determining the Variable Cash Target. Rather, our Compensation Committee’s determination of the Variable Cash Target

was subjective, based in part on the factors described above, and in part on internal pay equity, our compensation budget,

historical total cash opportunity levels and that the target performance goal for our fiscal year 2014 Variable Plan was set

at a level where target performance would result in our executives receiving variable compensation that would be competitive

with our peer companies. In setting the fiscal year 2014 Variable Cash Target (which became effective on January 28, 2013)

for our executive officers, our Compensation Committee specifically considered the following:

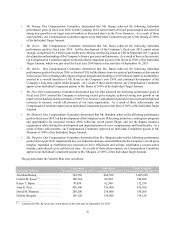

• Mr. Huang: For fiscal year 2014, as discussed above, our Compensation Committee increased Mr. Huang’s base

salary to $850,000, which placed him at slightly below the 25th percentile of chief executive officers at our peer

companies, and kept his Variable Cash Target flat at 156% of his base pay ($1,325,000) compared to 156%

($1,250,000) in fiscal year 2013, which positioned his total target cash opportunity between the 25th and 50th

percentile compared to other chief executive officers at our peer companies.

• Ms. Burns: Ms. Burns was not eligible to participate in the Variable Plan for fiscal year 2013; however, she received

a discretionary cash award for fiscal year 2013 of $100,000 for leading the finance team in a series of performance

achievements in fiscal year 2013, including achieving record revenues and gross margins, serving as Interim CFO

for a longer period than initially expected and because of her increased level of responsibility and the size and

complexity of her role. In determining the appropriate Variable Cash Target for fiscal year 2014 for Ms. Burns,

our Compensation Committee evaluated her contributions, and the market data for vice presidents of finance and

chief financial officers at our peer companies and decided that her Variable Cash Target for fiscal year 2014 should

be 25% of her base pay ($125,000).

• Mr. Puri: Our Compensation Committee increased the Variable Cash Target for Mr. Puri for fiscal year 2014 to

150% of his base pay ($750,000) from 100% ($500,000) in fiscal year 2013 in order to better reflect his scope of

responsibility, impact and desired market positioning. The Compensation Committee recognized that the variable

cash target opportunity relative to market was at significant levels, but determined that it was appropriate given

Mr. Puri’s responsibility as head of global sales and his impact on the results of the Company.

• Mr. Shannon: Our Compensation Committee increased the Variable Cash Target for Mr. Shannon for fiscal year

2014 to 100% of his base pay ($500,000) from 70% ($350,000) in fiscal year 2013 in order to better reflect his

scope of responsibility, impact and desired market positioning. The Compensation Committee recognized that

the variable cash target and total cash opportunity relative to market were at significant levels, but determined that

they were appropriate given Mr. Shannon’s scope of responsibility as head of both legal and human resources and

also his responsibility for launching our patent licensing program. In addition, the Compensation Committee took

into account internal pay equity with Mr. Puri.

• Ms. Shoquist: Our Compensation Committee increased the Variable Cash Target for Ms. Shoquist for fiscal year

2014 to 60% of her base pay ($300,000) up from 40% ($200,000) in fiscal year 2013 in order to better reflect her

scope of responsibility, impact and desired market positioning. The Compensation Committee recognized that the

total cash opportunity relative to market was at significant levels, but determined that it was appropriate given Ms.

Shoquist’s responsibility as head of global operations and her ability to impact Company results.

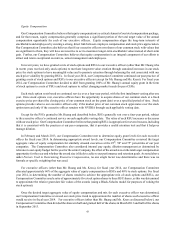

In connection with Ms. Kress’ appointment as our CFO, our Compensation Committee established a Variable Cash

Target of $550,000, or 110% of her base pay, for Ms. Kress. In setting this target, our Compensation Committee considered

peer data, her compensation at her prior employer, her ability to contribute to future results and internal pay equity factors.