NVIDIA 2013 Annual Report Download - page 242

Download and view the complete annual report

Please find page 242 of the 2013 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

98

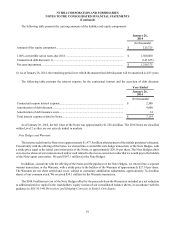

loss carryforwards of $366.9 million, include $91.4 million attributable to Germany, $250.4 million attributable to UK,

both of which may be carried forward indefinitely, $21.0 million attributable to Canada and the remainder to other foreign

jurisdictions that begin to expire in fiscal year 2015. As of January 26, 2014, we had federal research tax credit carryforwards

of $387.7 million that will begin to expire in fiscal year 2018. We have other federal tax credit carryforwards of $1.5 million

that will begin to expire in fiscal year 2015. The research tax credit carryforwards attributable to states is in the amount of

$369.2 million, of which $358.2 million is attributable to the State of California and may be carried over indefinitely, and

$11.0 million is attributable to various other states and will expire beginning in fiscal year 2015 according to the rules of

each particular state. We have other state tax credit carryforwards of $3.0 million that will expire in fiscal year 2026 and

other foreign tax credit carryforwards of $15.7 million, of which $4.7 million may be refunded in fiscal year 2016, $4.8

million may be refunded in fiscal year 2017 and $6.2 million may be refunded in fiscal year 2018 if not utilized. Our tax

attributes, net operating loss and tax credit carryforwards, remain subject to audit and may be adjusted for changes or

modification in tax laws, other authoritative interpretations thereof, or other facts and circumstances. Utilization of federal,

state, and foreign net operating losses and tax credit carryforwards may also be subject to limitations due to ownership

changes and other limitations provided by the Internal Revenue Code and similar state and foreign tax provisions. If any

such limitations apply, the federal, states, or foreign net operating loss and tax credit carryforwards, as applicable, may

expire or be denied before utilization.

As of January 26, 2014, U.S. federal and state income taxes have not been provided on approximately $1.96 billion of

undistributed earnings of non-United States subsidiaries as such earnings are considered to be indefinitely reinvested. We

have not provided the amount of unrecognized deferred tax liabilities for temporary differences related to investments in

our foreign subsidiaries as the determination of such amount is not practicable.

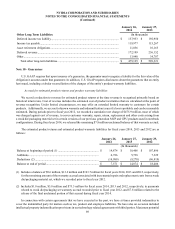

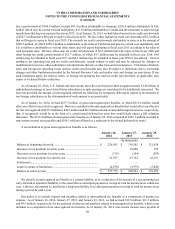

As of January 26, 2014, we had $237.7 million of gross unrecognized tax benefits, of which $215.4 million would

affect our effective tax rate if recognized. However, included in the unrecognized tax benefits that would affect our effective

tax rate if recognized of $215.4 million is $40.3 million and $0.2 million related to state and foreign income tax, respectively,

that, if recognized, would be in the form of a carryforward deferred tax asset that would likely attract a full valuation

allowance. The $215.4 million of unrecognized tax benefits as of January 26, 2014 consisted of $107.1 million recorded in

non-current income taxes payable and $108.3 million reflected as a reduction to the related deferred tax assets.

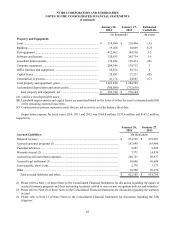

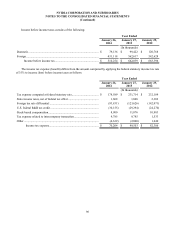

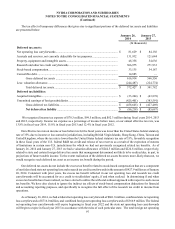

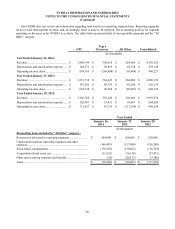

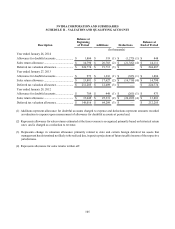

A reconciliation of gross unrecognized tax benefits is as follows:

January 26,

2014 January 27,

2013 January 29,

2012

(In thousands)

Balance at beginning of period............................................................. $ 220,543 $ 138,262 $ 121,034

Increases in tax positions for prior years.............................................. — 18,800 385

Decreases in tax positions for prior years............................................. (714)(304)(293)

Increases in tax positions for current year............................................ 22,787 67,764 22,181

Settlements............................................................................................ ———

Lapse in statute of limitations............................................................... (4,878)(3,979)(5,045)

Balance at end of period ....................................................................... $ 237,738 $ 220,543 $ 138,262

We classify an unrecognized tax benefit as a current liability, or as a reduction of the amount of a net operating loss

carry-forward or amount refundable, to the extent that we anticipate payment or receipt of cash for income taxes within one

year. Likewise, the amount is classified as a long-term liability if we anticipate payment or receipt of cash for income taxes

during a period beyond a year.

Our policy is to include interest and penalties related to unrecognized tax benefits as a component of income tax

expense. As of January 26, 2014, January 27, 2013, and January 29, 2012, we had accrued $12.9 million, $11.3 million,

and $9.5 million, respectively, for the payment of interest and penalties related to unrecognized tax benefits, which is not

included as a component of our unrecognized tax benefits. As of January 26, 2014, non-current income taxes payable of