NVIDIA 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

In addition, we believe our executive officers should generally be treated in the same way as our employees. Consistent

with this philosophy, they are eligible for certain accelerated equity vesting provisions under our equity incentive plans on

the same terms and conditions as our other employees. As described in greater detail below under the heading Employment,

Severance and Change-in-Control Arrangements, the vesting of all of the stock options or RSUs held by our employees,

including our executive officers, would be accelerated if they were not assumed or substituted by an acquiring company in

a change-in-control transaction.

Additional Executive Compensation Practices, Policies and Procedures

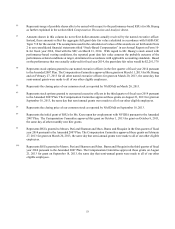

Compensation Recovery Policy

In April 2009, our Board adopted a Compensation Recovery Policy which covers all of our employees. Under this

policy, if we are required to prepare an accounting restatement to correct an accounting error on an interim or annual financial

statement included in a report on Form 10-Q or Form 10-K due to material noncompliance with any financial reporting

requirement under the federal securities laws, or a Restatement, and if the Board or a committee of independent directors

concludes that our CEO, CFO or any other officer or employee received a variable compensation payment that would not

have been payable if the original interim or annual financial statements reflected the Restatement, then under the

Compensation Recovery Policy:

• Our CEO or CFO will be required to disgorge the net after-tax amount of that portion of the variable

compensation payment that would not have been payable if the original interim or annual financial statements

reflected the Restatement; and

• The Board or the committee of independent directors may require any other officer or employee to repay all

(or a portion of) the variable compensation payment that would not have been payable if the original interim

or annual financial statements reflected the Restatement, as determined by the Board or such committee in its

sole discretion. In using its discretion, the Board or the independent committee may consider whether such

person was involved in the preparation of our financial statements or otherwise caused the need for the

Restatement and may, to the extent permitted by applicable law, recoup amounts by (1) requiring partial or

full repayment by such person of any variable or incentive compensation or any gains realized on the exercise

of stock options or on the open-market sale of vested shares, (2) cancelling (in full or in part) any outstanding

equity awards held by such person and/or (3) adjusting the future compensation of such person.

We will review and update the Compensation Recovery Policy as necessary for compliance with the clawback policy

provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act when the final regulations related to that

policy are issued.

Stock Ownership Guidelines

Our Corporate Governance Policies require each executive officer to hold at least 25,000 shares of our common stock

during the period in which he or she serves as an executive officer, unless our NCGC waives the requirement. The 25,000

shares may include vested but unexercised stock options and vested but unissued RSUs. Executive officers have 18 months

from the date that they become executive officers to reach the ownership threshold. See the section titled Executive Summary

for the current holdings of our executive officers.

Hedging and Pledging Policy

Since our initial public offering in 1999, our policies have not allowed our employees, including our executive officers,

to engage in transactions to “hedge” ownership of our stock, including short sales or trading in any derivatives involving

our securities. We believe this policy is consistent with good corporate governance and with our pay-for-performance

compensation model. Our policies also do not allow pledging of our common stock.