Foot Locker 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

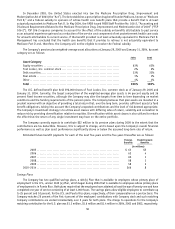

Exhibit No.

in Item 601 of

Regulation S-K Description

10.5 Amendment to the Foot Locker 1998 Stock Option and Award Plan (incorporated herein by

reference to Exhibit 10.2 to the Registrant’s Quarterly Report on Form 10-Q for the period ended

July 29, 2000, filed by the Registrant with the SEC on September 7, 2000 (the “July 29, 2000

Form 10-Q”)).

10.6 Executive Supplemental Retirement Plan (incorporated herein by reference to Exhibit 10(d) to

the Registration Statement on Form 8-B filed by the Registrant with the SEC on August 7, 1989

(Registration No. 1-10299) (the “8-B Registration Statement”)).

10.7 Amendment to the Executive Supplemental Retirement Plan (incorporated herein by reference to

Exhibit 10(c)(i) to the 1994 Form 10-K ).

10.8 Amendment to the Executive Supplemental Retirement Plan (incorporated herein by reference to

Exhibit 10(d)(ii) to the 1995 Form 10-K).

10.9 Supplemental Executive Retirement Plan (incorporated herein by reference to Exhibit 10(e) to

the 1995 Form 10-K).

10.10 Long-Term Incentive Compensation Plan, as amended and restated (incorporated herein by

reference to Exhibit 10(f) to the 1995 Form 10-K).

10.11 Annual Incentive Compensation Plan, as amended (incorporated herein by reference to Exhibit

10.3 to the Quarterly Report on Form 10-Q for the quarterly period ended August 2, 2003 filed

by the Registrant with the SEC on September 15, 2003 (the “August 2, 2003 Form 10-Q”)).

10.12 Form of indemnification agreement, as amended (incorporated herein by reference to Exhibit

10(g) to the 8-B Registration Statement).

10.13 Amendment to form of indemnification agreement (incorporated herein by reference to Exhibit

10.5 to the Quarterly Report on Form 10-Q for the quarterly period ended May 5, 2001 filed by

the Registrant with the SEC on June 13, 2001 (the “May 5, 2001 Form 10-Q”)).

10.14 Foot Locker Voluntary Deferred Compensation Plan (incorporated herein by reference to Exhibit

10(i) to the 1995 Form 10-K).

10.15 Foot Locker Directors Stock Option Plan (incorporated herein by reference to Exhibit 10.1 to the

July 29, 2000 Form 10-Q).

10.16 Trust Agreement dated as of November 12, 1987 (“Trust Agreement”), between F.W. Woolworth

Co. and The Bank of New York, as amended and assumed by the Registrant (incorporated herein

by reference to Exhibit 10(j) to the 8-B Registration Statement).

10.17 Amendment to Trust Agreement made as of April 11, 2001 (incorporated herein by reference to

Exhibit 10.4 to May 5, 2001 Form 10-Q).

10.18 Foot Locker Directors’ Retirement Plan, as amended (incorporated herein by reference to Exhibit

10(k) to the 8-B Registration Statement).

10.19 Amendments to the Foot Locker Directors’ Retirement Plan (incorporated herein by reference to

Exhibit 10(c) to the Registrant’s Quarterly Report on Form 10-Q for the period ended October 28,

1995, filed by the Registrant with the SEC on December 11, 1995 (the “October 28, 1995 Form

10-Q”)).

10.20 Employment Agreement with Matthew D. Serra dated as of February 9, 2005 (incorporated herein

by reference to Exhibit 10.1 to the Current Report on Form 8-K dated February 9, 2005 filed by

the Registrant with the SEC on February 11, 2005 (the “February 9, 2005 Form 8-K”)).

60