Foot Locker 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

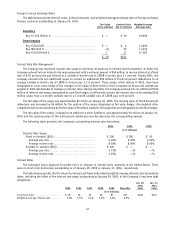

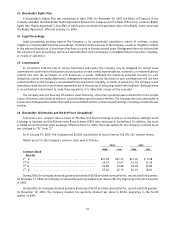

FIVE YEAR SUMMARY OF SELECTED FINANCIAL DATA

The selected financial data below should be read in conjunction with the Consolidated Financial Statements and the

notes thereto and other information contained elsewhere in this report. All selected financial data have been restated

for discontinued operations and the reclassification of tenant allowances as deferred rent credits.

2004 2003 2002 2001 2000

($ in millions, except per share amounts)

Summary of Continuing Operations

Sales ....................................................................... $5,355 4,779 4,509 4,379 4,356

Gross margin

(1)

............................................................. 1,633 1,482 1,348 1,312 1,312

Selling, general and administrative expenses.................................... 1,088 987 928 923 975

Restructuring charges (income) ............................................... 2 1 (2) 34 1

Depreciation and amortization

(1)

............................................. 154 152 153 158 154

Interest expense, net ......................................................... 15 18 26 24 22

Other (income) expense ...................................................... — — (3) (2) (16)

Income from continuing operations ............................................ 255 209 162 111

(3)

107

(3)

Cumulative effect of accounting change

(2)

..................................... — (1) — — (1)

Basic earnings per share from continuing operations ............................ 1.69 1.47 1.15 0.79

(3)

0.78

(3)

Basic earnings per share from cumulative effect of accounting change . . .......... ————(0.01)

Diluted earnings per share from continuing operations .......................... 1.64 1.40 1.10 0.77

(3)

0.77

(3)

Diluted earnings per share from cumulative effect of accounting change .......... ————(0.01)

Common stock dividends declared ............................................. 0.26 0.15 0.03 — —

Weighted-average common shares outstanding (in millions)...................... 150.9 141.6 140.7 139.4 137.9

Weighted-average common shares outstanding assuming dilution (in millions) .... 157.1 152.9 150.8 146.9 139.1

Financial Condition

Cash, cash equivalents and short-term investments ............................. $ 492 448 357 215 109

Merchandise inventories ...................................................... 1,151 920 835 793 730

Property and equipment, net

(4)

............................................... 715 668 664 665 712

Total assets

(4)

.............................................................. 3,237 2,713 2,514 2,328 2,306

Short-term debt ............................................................. —————

Long-term debt and obligations under capital leases ............................ 365 335 357 399 313

Total shareholders’ equity .................................................... 1,830 1,375 1,110 992 1,013

Financial Ratios

Return on equity (ROE) ....................................................... 15.9% 16.8 15.4 11.1 10.0

Operating profit margin ...................................................... 7.3% 7.2 6.0 4.5 4.2

Income from continuing operations as a percentage of sales ..................... 4.8% 4.4 3.6 2.5

(3)

2.5

(3)

Net debt capitalization percent

(5)

............................................ 50.4% 53.3 58.6 61.1 60.9

Net debt capitalization percent (without present value of operating leases)

(5)

.... — — — 15.6 16.8

Current ratio ................................................................. 2.7 2.8 2.2 2.0 1.5

Other Data

Capital expenditures ......................................................... $ 156 144 150 116 94

Number of stores at year end ................................................. 3,967 3,610 3,625 3,590 3,752

Total selling square footage at year end (in millions) ............................ 8.89 7.92 8.04 7.94 8.09

Total gross square footage at year end (in millions) ............................. 14.78 13.14 13.22 13.14 13.32

(1) Gross margin and depreciation expense include the effects of the reclassification of tenant allowances as deferred credits, which are amortized

as a reduction of rent expense as a component of costs of sales. Gross margin was reduced by $5 million in 2004 and 2003, $4 million in 2002

and 2001 and $3 million in 2000 and accordingly, depreciation expense was increased by the corresponding amount.

(2) 2003 relates to adoption of SFAS No. 143 “Accounting for Asset Retirement Obligations” (see note 1). 2000 reflects change in method of accounting

for layaway sales.

(3) As more fully described in note 16, applying the provisions of EITF 90-16, income from continuing operations for 2001 and 2000 would have been

reclassified to include the results of the Northern Group. Accordingly, income from continuing operations would have been $91 million and $57

million, respectively. As such basic earnings per share would have been $0.65 and $0.42 for fiscal 2001 and 2000, respectively. Diluted earnings

per share would have been $0.64 and $0.41 for fiscal 2001 and 2000, respectively. However, upon achieving divestiture accounting in the fourth

quarter of 2002, the results would have been reclassified to reflect the results as shown above and as originally reported by the Company.

(4) Property and equipment, net and total assets include the reclassification of tenant allowances as deferred credits, which were previously recorded

as a reduction to the cost of property and equipment, and are now classified as part of the deferred rent liability. Property and equipment, net

and total assets were increased by $22 million in 2004, $24 million in 2003 and $28 million in each of 2002, 2001 and 2000.

(5) Represents total debt, net of cash, cash equivalents and short-term investments and excludes the effect of interest rate swaps of $4 million that

increased long-term debt at January 29, 2005 and $1 million that reduced long-term debt at January 31, 2004.

55