Foot Locker 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

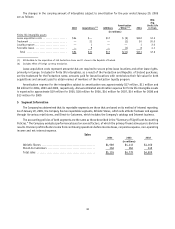

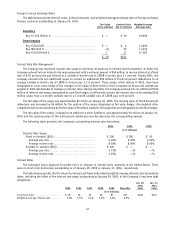

The major components of the pre-tax losses (gains) on disposal and disposition activity related to the reserves are

presented below:

Northern Group 2001 2002 2003 2004

Balance

Charge/

(Income)

Net

Usage* Balance

Charge/

(Income)

Net

Usage* Balance

Charge/

(Income)

Net

Usage* Balance

(in millions)

Asset write-offs & impairments ....... $— $ 18 $(18) $— $— $— $— $— $— $—

Recognition of note receivable ....... — (10) 10 — — — — — — —

Real estate & lease liabilities ......... 6 1 (1) 6 1 (7) — — — —

Severance & personnel .............. 2 — (2) — — — — — — —

Operating losses & other costs ........ 3 — (2) 1 — 1 2 — 1 3

Total ............................ $11 $ 9 $(13) $ 7 $ 1 $(6) $ 2 $— $ 1 $ 3

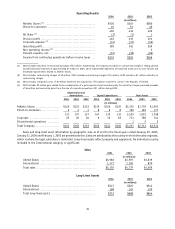

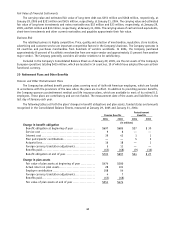

International General Merchandise

2001 2002 2003 2004

Balance

Charge/

(Income)

Net

Usage* Balance

Charge/

(Income)

Net

Usage* Balance

Charge/

(Income)

Net

Usage* Balance

(in millions)

Woolco ........................... $— $ 1 $— $ 1 $— $(1) $— $— $— $—

The Bargain! Shop ................. 6 — — 6 — (1) 5 — — 5

Total ............................ $ 6 $ 1 $— $ 7 $— $(2) $ 5 $— $— $ 5

Specialty Footwear 2001 2002 2003 2004

Balance

Charge/

(Income)

Net

Usage Balance

Charge/

(Income)

Net

Usage Balance

Charge/

(Income)

Net

Usage Balance

(in millions)

Lease liabilities .................... $ 7 $(4) $(1) $ 2 $— $— $ 2 $— $— $ 2

Operating losses & other costs ........ 2 — (1) 1 — (1) — (1) 1 —

Total ............................ $ 9 $(4) $(2) $ 3 $— $(1) $ 2 $(1) $ 1 $ 2

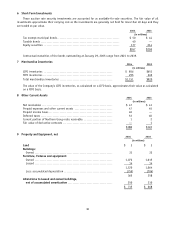

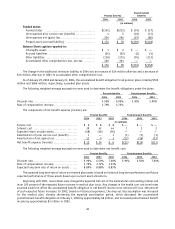

Domestic General Merchandise 2001 2002 2003 2004

Balance

Charge/

(Income)

Net

Usage Balance

Charge/

(Income)

Net

Usage Balance

Charge/

(Income)

Net

Usage Balance

(in millions)

Lease liabilities .................... $10 $— $(3) $ 7 $— $(1) $ 6 $— $— $ 6

Legal and other costs ............... 2 5 (4) 3 4 (3) 4 — (2) 2

Total ............................ $12 $ 5 $(7) $10 $ 4 $(4) $10 $— $(2) $ 8

* Net usage includes effect of foreign exchange translation adjustments

42