Foot Locker 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

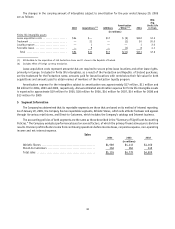

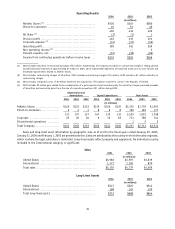

and $4 million in 2002. There was no change to net income for the years presented. The effect on the Consolidated

Statements of Cash Flows was not significant for the years ended January 31, 2004 and February 1, 2003 and therefore

have not been reclassified.

Recent Accounting Pronouncements Not Previously Discussed Herein

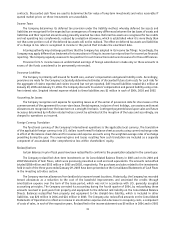

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs — an amendment of ARB 43, Chapter 4.” This

Statement amends the guidance to clarify that abnormal amounts of idle facility expense, freight, handling costs, and

wasted materials (spoilage) should be recognized as current-period charges. In addition, this Statement requires that

allocation of fixed production overheads to the costs of conversions be based on the normal capacity of the production

facilities. The Statement is effective for inventory costs incurred during fiscal years beginning after June 15, 2005.

Management does not believe that the effect of the adoption of this Statement will have a material effect on its financial

position and results of operations.

In December 2004, the FASB issued SFAS No. 153, “Exchanges of Nonmonetary Assets — an amendment of APB

Opinion No. 29, Accounting for Nonmonetary Transactions.” This Statement requires that exchanges should be recorded

and measured at the fair value of the assets exchanged, with certain exceptions. The Statement is effective for

nonmonetary asset exchanges occurring in fiscal periods beginning after June 15, 2005. Management does not believe

that the adoption of this Statement will have a material effect on its financial position and results of operations as the

Company does not currently have any exchanges of nonmonetary assets.

2 Acquisitions

Footaction

The Company consummated its purchase of 349 Footaction stores from Footstar, Inc. on May 7, 2004. Footstar, Inc.

filed for Chapter 11 bankruptcy protection on March 2, 2004; consequently, the disposition of its Footaction stores was

conducted under a Bankruptcy Code Section 363 sale process. The U.S. Bankruptcy Court approved the sale on April 21,

2004 and the waiting period required under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 expired on May 4,

2004. The agreement to acquire the Footaction stores was in line with the Company’s strategic priorities, including the

acquisition of compatible athletic footwear and apparel retail companies. The Company’s consolidated results of

operations include those of Footaction beginning with the date that the acquisition was consummated.

The Company integrated the Footaction business into the Athletic Stores segment and is operating the majority of

the stores under the Footaction name. The purchase price of $222 million was increased for direct costs related to the

acquisition totaling $4 million. Direct costs include investment banking, legal and accounting fees and other costs. The

Company has allocated the purchase price of approximately $226 million based, in part, upon internal estimates of cash

flows, recoverability and independent appraisals, and may be revised as more definitive facts and evidence become

available. Pro forma effects of the acquisition have not been presented, as their effects were not significant to the

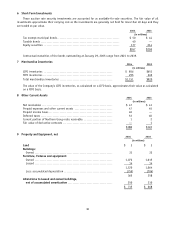

consolidated results of operations. The allocation of the purchase price is detailed below:

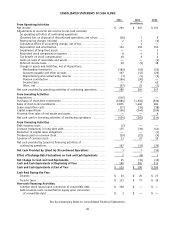

(in millions)

Inventory ................................................................................. $ 39

Property and equipment .................................................................. 45

Intangible assets — amortizing .......................................................... 29

Goodwill .................................................................................. 122

Total assets ............................................................................ 235

Accounts payable and accrued liabilities

(1)

............................................... 5

Other liabilities

(2)

........................................................................ 4

Total liabilities ........................................................................... 9

Total purchase price .................................................................... $226

(1) “Accounts payable and accrued liabilities” include approximately $3 million for anticipated payments to landlords to cancel two of the acquired

leases. Also included is approximately $1 million of liabilities related to gift cards assumed. The remaining $1 million relates to transfer taxes

and real estate charges assumed from Footstar, Inc. as part of the acquisition.

(2) “Other liabilities” includes $4 million of liabilities assumed for leased locations with rents above their fair value.

32