Foot Locker 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.contracts. Discounted cash flows are used to determine the fair value of long-term investments and notes receivable if

quoted market prices on these instruments are unavailable.

Income Taxes

The Company determines its deferred tax provision under the liability method, whereby deferred tax assets and

liabilities are recognized for the expected tax consequences of temporary differences between the tax bases of assets and

liabilities and their reported amounts using presently enacted tax rates. Deferred tax assets are recognized for tax credits

and net operating loss carryforwards, reduced by a valuation allowance, which is established when it is more likely than

not that some portion or all of the deferred tax assets will not be realized. The effect on deferred tax assets and liabilities

of a change in tax rates is recognized in income in the period that includes the enactment date.

A taxing authority may challenge positions that the Company has adopted in its income tax filings. Accordingly, the

Company may apply different tax treatments for transactions in filing its income tax returns than for income tax financial

reporting. The Company regularly assesses its tax position for such transactions and records reserves for those differences.

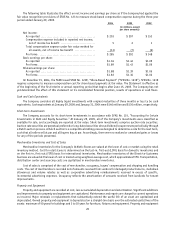

Provision for U.S. income taxes on undistributed earnings of foreign subsidiaries is made only on those amounts in

excess of the funds considered to be permanently reinvested.

Insurance Liabilities

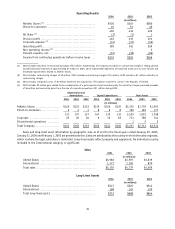

The Company is primarily self-insured for health care, workers’ compensation and general liability costs. Accordingly,

provisions are made for the Company’s actuarially determined estimates of discounted future claim costs for such risks for

the aggregate of claims reported and claims incurred but not yet reported. Self-insured liabilities totaled $14 million at

January 29, 2005 and January 31, 2004. The Company discounts its workers’ compensation and general liability using a risk-

free interest rate. Imputed interest expense related to these liabilities was $1 million in each of 2004, 2003 and 2002.

Accounting for Leases

The Company recognizes rent expense for operating leases as of the earlier of possession date for store leases or the

commencement of the agreement for a non-store lease. Rental expense, inclusive of rent holidays, concessions and tenant

allowances are recognized over the lease term on a straight-line basis. Contingent payments based upon sales and future

increases determined by inflation related indices cannot be estimated at the inception of the lease and accordingly, are

charged to operations as incurred.

Foreign Currency Translation

The functional currency of the Company’s international operations is the applicable local currency. The translation

of the applicable foreign currency into U.S. dollars is performed for balance sheet accounts using current exchange rates

in effect at the balance sheet date and for revenue and expense accounts using the weighted-average rates of exchange

prevailing during the year. The unearned gains and losses resulting from such translation are included as a separate

component of accumulated other comprehensive loss within shareholders’ equity.

Reclassifications

Certain balances in prior fiscal years have been reclassified to conform to the presentation adopted in the current year.

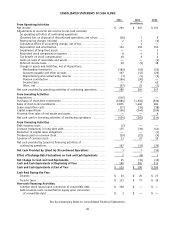

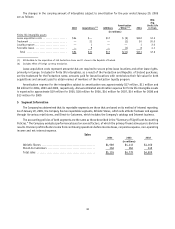

The Company reclassified short-term investments on its Consolidated Balance Sheets in 2003 and on its 2003 and

2002 Statements of Cash Flows, which were previously presented as cash and cash equivalents. The amounts reclassified

totaled $258 million and $152 million in 2003 and 2002, respectively. The purchases and sales related to the investments

held in each of the three years ended January 29, 2005 have been presented on the Consolidated Statements of Cash Flows

in the investing activities section.

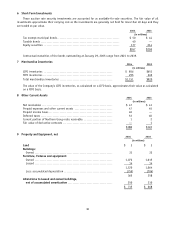

The Company receives allowances from landlords to improve tenant locations. Historically, the Company has recorded

tenant allowances as a reduction to the cost of the leasehold improvements and amortized the credits through

amortization expense over the term of the lease period, which was not in accordance with U.S. generally accepted

accounting principles. The Company corrected its accounting during the fourth quarter of 2004, by reclassifying those

amounts received in past years from property and equipment to the deferred rent liability on the Consolidated Balance

Sheets. Balances reclassified from property and equipment to the straight-line liability, which is included in other

liabilities, was $22 million in 2004 and $24 million in 2003. The Company also reclassified amounts on the Consolidated

Statements of Operations to reflect an increase in amortization expense and a decrease in occupancy costs, a component

of costs of sales, in each of the respective years. Reclassified in the income statement was $5 million in 2004 and in 2003

31