Foot Locker 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

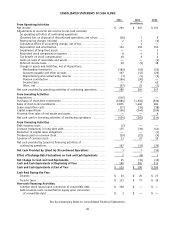

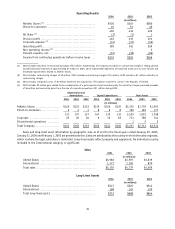

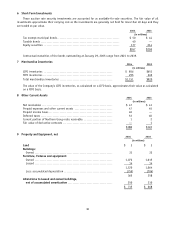

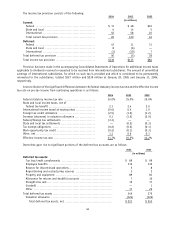

6 Short-Term Investments

These auction rate security investments are accounted for as available-for-sale securities. The fair value of all

investments approximate their carrying cost as the investments are generally not held for more than 49 days and they

are traded at par value.

2004 2003

(in millions)

Tax exempt municipal bonds ..................................................... $ 50 $ 44

Taxable bonds ................................................................... 40 —

Equity securities ................................................................ 177 214

$267 $258

Contractual maturities of the bonds outstanding at January 29, 2005 range from 2021 to 2039.

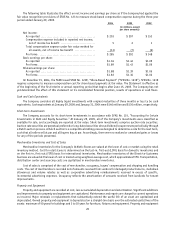

7 Merchandise Inventories 2004 2003

(in millions)

LIFO inventories .......................................................... $ 856 $651

FIFO inventories ........................................................... 295 269

Total merchandise inventories ............................................. $1,151 $920

The value of the Company’s LIFO inventories, as calculated on a LIFO basis, approximates their value as calculated

on a FIFO basis.

8 Other Current Assets 2004 2003

(in millions)

Net receivables ............................................................ $ 47 $ 41

Prepaid expenses and other current assets ................................ 47 45

Prepaid income taxes ...................................................... 40 —

Deferred taxes ............................................................. 53 60

Current portion of Northern Group note receivable ........................ 1 2

Fair value of derivative contracts .......................................... — 1

$188 $149

9 Property and Equipment, net 2004 2003

(in millions)

Land $3 $3

Buildings:

Owned .................................................................. 31 32

Furniture, fixtures and equipment:

Owned .................................................................. 1,072 1,015

Leased .................................................................. 14 14

1,120 1,064

Less: accumulated depreciation ......................................... (755) (706)

365 358

Alterations to leased and owned buildings,

net of accumulated amortization ...................................... 350 310

$ 715 $ 668

36