Foot Locker 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

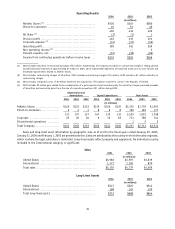

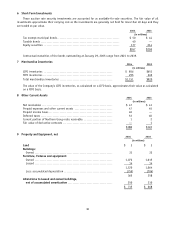

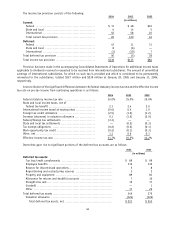

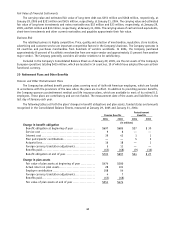

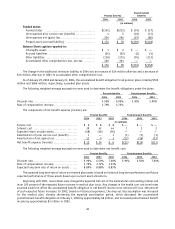

2004 2003

(in millions)

Deferred tax liabilities:

Inventories.............................................................. $ 8 $ 13

Goodwill................................................................. 2 —

Other.................................................................... 1 1

Total deferred tax liabilities................................................ 11 14

Net deferred tax asset ..................................................... $210 $239

Balance Sheet caption reported in:

Deferred taxes........................................................... $180 $194

Other current assets..................................................... 53 60

Other current liabilities.................................................. (1) —

Other liabilities.......................................................... (22) (15)

$210 $239

The Company operates in multiple taxing jurisdictions and is subject to audit. Audits can involve complex issues and

may require an extended period of time to resolve. A taxing authority may challenge positions that the Company has

adopted in its income tax filings. Accordingly, the Company may apply different tax treatments for transactions in filing

its income tax returns than for income tax financial reporting. The Company regularly assesses its tax position for such

transactions and records reserves for those differences.

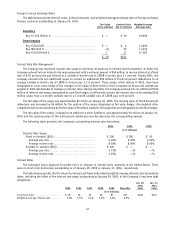

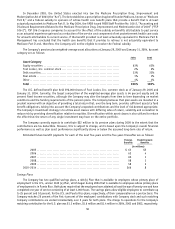

The Company’s U.S. Federal income tax filings have been examined by the Internal Revenue Service (the “IRS”)

through 2003. The IRS has begun a voluntary pre-filing review process for 2004. The pre-filing review process is expected

to conclude during 2005. The Company has also agreed to participate in the IRS’ Compliance Assurance Process (“CAP”)

for 2005.

The American Jobs Creation Act of 2004 (the “Act”) was signed into law on October 22, 2004. The Act contains

numerous amendments and additions to the U.S. corporate income tax rules. None of these changes, either individually

or in the aggregate, is expected to have a significant effect on the Company’s income tax liability. The Company does

not expect to take advantage of the Act’s repatriation provisions.

As of January 29, 2005, the Company had a valuation allowance of $124 million to reduce its deferred tax assets to

an amount that is more likely than not to be realized. The valuation allowance primarily relates to the deferred tax assets

arising from state tax loss carryforwards, tax loss carryforwards of certain foreign operations and capital loss carryforwards

and unclaimed tax depreciation of the Canadian operations. The net change in the total valuation allowance for the year

ended January 29, 2005, was principally due to an increase in the Canadian and state valuation allowances relating,

respectively, to a current year increase in Canadian deferred tax assets and state net operating losses for which the

Company does not expect to receive future benefit.

Based upon the level of historical taxable income and projections for future taxable income over the periods in which

the temporary differences are anticipated to reverse, management believes it is more likely than not that the Company

will realize the benefits of these deductible differences, net of the valuation allowances at January 29, 2005. However,

the amount of the deferred tax asset considered realizable could be adjusted in the future if estimates of taxable income

are revised.

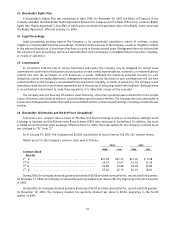

At January 29, 2005, the Company’s tax loss/credit carryforwards included international operating loss carryforwards

with a potential tax benefit of $33 million. Those expiring between 2005 and 2011 total $32 million and those that do

not expire total $1 million. The Company also had state net operating loss carryforwards with a potential tax benefit of

$28 million, which principally related to the 16 states where the Company does not file a combined return. These loss

carryforwards expire between 2005 and 2025 as well as foreign tax credits totaling $1 million, which expire 2015. The

Company had U.S. Federal alternative minimum tax credits and Canadian capital loss carryforwards of approximately $17

million and $10 million, respectively, which do not expire.

45