Foot Locker 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

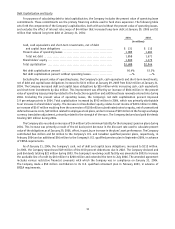

Costs and Expenses

Selling, General and Administrative Expenses

SG&A increased by $101 million to $1,088 million in 2004, or by 10.2 percent, as compared with 2003. Excluding

the effect of foreign currency fluctuations, primarily related to the euro, SG&A increased by $82 million, of which the

acquired businesses contributed $68 million. Increased payroll and related costs primarily comprised the balance of the

increase. SG&A as a percentage of sales decreased to 20.3 percent compared with 20.7 percent in 2003. Pension expense

declined by $2 million primarily as a result of the positive market performance experienced in the prior year. Additionally,

postretirement income decreased by $2 million in 2004 as compared with 2003 as the amortization of the unrecognized

gains, which are amortized over the average remaining life expectancy, continues to decrease over time.

SG&A increased by $59 million to $987 million in 2003, or by 6.4 percent, as compared with 2002. Excluding the

effect of foreign currency fluctuations, primarily related to the euro, SG&A increased by 2.7 percent. The increases were

for additional payroll costs of $16 million in Europe, primarily as a result of new store openings and $12 million related

to compensation costs for incentive bonuses due to the Company’s performance. Additionally, pension expense increased

by $8 million due to the decline in plan asset values experienced in prior years, partially offset by a $4 million increase

in the recognition of postretirement income and foreign exchange gain recorded in 2002. During 2002, the Company

recorded asset impairment charges of $6 million and $1 million related to the Kids Foot Locker and Lady Foot Locker

formats, respectively. SG&A as a percentage of sales remained relatively flat compared with 2002.

Depreciation and Amortization

Depreciation and amortization of $154 million increased by 1.3 percent in 2004 from $152 million in 2003.

Depreciation and amortization of acquired businesses amounted to $7 million for 2004. These increases were offset by

declines that were a result of older assets becoming fully depreciated.

Depreciation and amortization of $152 million in 2003 remained relatively flat as compared with $153 million in 2002.

Excluding the effect of foreign currency fluctuations, depreciation and amortization declined by $4 million. The decrease

relates primarily to assets becoming fully depreciated for the U.S. Athletic stores, offset in part by an increase related

to the European new stores.

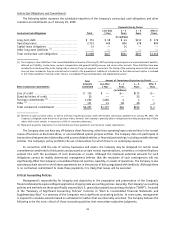

Interest Expense, Net

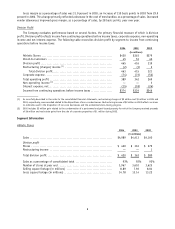

2004 2003 2002

(in millions)

Interest expense ........................................... $ 22 $ 26 $ 33

Interest income ............................................ (7) (8) (7)

Interest expense, net ................................. $ 15 $ 18 $ 26

Weighted-average interest rate (excluding facility fees):

Short-term debt ....................................... —% —% —%

Long-term debt ....................................... 5.2% 6.1% 7.2%

Total debt ............................................. 5.2% 6.1% 7.2%

Short-term debt outstanding during the year:

High .................................................. $ — $ — $ —

Weighted-average ..................................... $ — $ — $ —

Interest expense of $22 million declined by 15.4 percent in 2004 from $26 million in 2003. The decrease in 2004

was primarily attributable to the Company’s $150 million 5.50 percent convertible subordinated notes that were converted

to equity in June 2004. Also contributing to the reduction in interest expense was the repurchase of $19 million of the

8.50 percent debentures payable in 2022 in the latter part of 2003. The Company continued to utilize interest rate swap

agreements, which reduced interest expense by approximately $3 million and $4 million in 2004 and 2003, respectively.

These decreases were offset, in part, by an increase resulting from the interest on the $175 million term loan that

commenced in May 2004.

9