Foot Locker 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

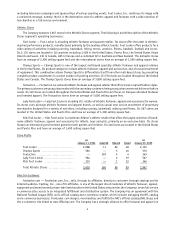

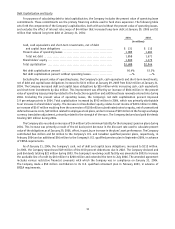

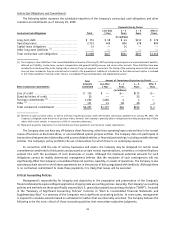

Debt Capitalization and Equity

For purposes of calculating debt to total capitalization, the Company includes the present value of operating lease

commitments. These commitments are the primary financing vehicle used to fund store expansion. The following table

sets forth the components of the Company’s capitalization, both with and without the present value of operating leases,

and excludes the effect of interest rate swaps of $4 million that increased long-term debt at January 29, 2005 and $1

million that reduced long-term debt at January 31, 2004:

2004 2003

(in millions)

Cash, cash equivalents and short-term investments, net of debt

and capital lease obligations ........................................... $ 131 $ 112

Present value of operating leases ......................................... 1,989 1,683

Total net debt .......................................................... 1,858 1,571

Shareholders’ equity ....................................................... 1,830 1,375

Total capitalization ....................................................... $3,688 $2,946

Net debt capitalization percent ........................................... 50.4% 53.3%

Net debt capitalization percent without operating leases .................. —% —%

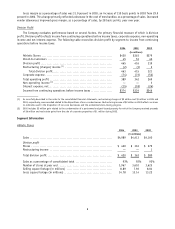

Excluding the present value of operating leases, the Company’s cash, cash equivalents and short-term investments,

net of debt and capital lease obligations increased to $131 million at January 29, 2005 from $112 million at January 31,

2004. The Company increased debt and capital lease obligations by $25 million while increasing cash, cash equivalents

and short-term investments by $44 million. This improvement was offset by an increase of $306 million in the present

value of operating leases primarily related to the Footaction acquisition and additional lease renewals entered into during

2004. Including the present value of operating leases, the Company’s net debt capitalization percent improved

2.9 percentage points in 2004. Total capitalization increased by $742 million in 2004, which was primarily attributable

to an increase in shareholders’ equity. The increase in shareholders’ equity relates to net income of $293 million in 2004,

an increase of $147 million resulting from the conversion of $150 million subordinated notes to equity, net of unamortized

deferred issuance costs, $49 million related to employee stock plans, and an increase of $19 million in the foreign exchange

currency translation adjustment, primarily related to the strength of the euro. The Company declared and paid dividends

totaling $39 million during 2004.

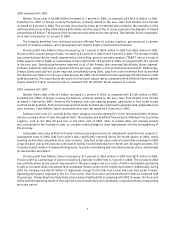

The Company also recorded an increase of $14 million to the minimum liability for the Company’s pension plans during

2004. This increase was primarily a result of the 40 basis point decrease in the discount rate used to calculate present

value of the obligations as of January 29, 2005, offset, in part, by an increase in the plans’ asset performance. The Company

contributed $44 million and $6 million to the Company’s U.S. and Canadian qualified pension plans, respectively, in

February 2004 and an additional $56 million to the Company’s U.S. qualified pension plan in September 2004, in advance

of ERISA requirements.

As of January 31, 2004, the Company’s cash, net of debt and capital lease obligations, increased to $112 million.

In 2003, the Company repurchased $19 million of the 8.50 percent debentures due in 2022. The Company declared and

paid dividends totaling $21 million during 2003. The Company’s revolving credit facility was amended in 2003 to increase

the available line of credit by $10 million to $200 million and extended the term to July 2006. The amended agreement

includes various restrictive financial covenants with which the Company was in compliance on January 31, 2004.

The Company made a $50 million contribution to its U.S. qualified retirement plan in February 2003, in advance of

ERISA requirements.

13