Foot Locker 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21 Stock Plans

In 2003, the Company adopted the 2003 Stock Option and Award Plan (the “2003 Stock Option Plan”) and the 2003

Employees Stock Purchase Plan (the “2003 Stock Purchase Plan”). Under the 2003 Stock Option Plan, options, restricted

stock, stock appreciation rights (SARs), or other stock-based awards may be granted to officers and other employees at

not less than the market price on the date of the grant. Unless a longer or shorter period is established at the time of

the option grant, generally, one-third of each stock option grant becomes exercisable on each of the first three anniversary

dates of the date of grant. The maximum number of shares of stock reserved for issuance pursuant to the 2003 Stock Option

Plan is 4,000,000 shares. The number of shares reserved for issuance as restricted stock and other stock-based awards

cannot exceed 1,000,000 shares. The Company adopted the 2003 Stock Purchase Plan whose terms are substantially the

same as the 1994 Employees Stock Purchase Plan (the “1994 Stock Purchase Plan”) which expired in June 2004. Under

the 2003 Stock Purchase Plan, 3,000,000 shares of common stock will be available for purchase beginning June 2005.

The Company’s 1998 Stock Option and Award Plan (the “1998 Plan”), options to purchase shares of common stock may

be granted to officers and other employees at not less than the market price on the date of grant. Under the plan, the Company

may grant officers and other employees, including those at the subsidiary level, stock options, SARs, restricted stock or other

stock-based awards. Generally, one-third of each stock option grant becomes exercisable on each of the first three anniversary

dates of the date of grant. The options terminate up to 10 years from the date of grant. In 2000, the Company amended the

1998 Plan to provide for awards of up to 12,000,000 shares of the Company’s common stock. The number of shares reserved

for issuance as restricted stock and other stock-based awards, as amended, cannot exceed 3,000,000 shares.

In addition, options to purchase shares of common stock remain outstanding under the Company’s 1995 and 1986

stock option plans. The 1995 Stock Option and Award Plan (the “1995 Plan”) is substantially the same as the 1998 Plan.

The number of shares authorized for awards under the 1995 Plan is 6,000,000 shares. The number of shares reserved for

issuance as restricted stock under the 1995 Plan is limited to 1,500,000 shares. No further awards may be made under

the 1995 Plan as of March 8, 2005. Options granted under the 1986 Stock Option Plan (the “1986 Plan”) generally become

exercisable in two equal installments on the first and the second anniversaries of the date of grant. No further options

may be granted under the 1986 Plan.

The 2002 Foot Locker Directors’ Stock Plan replaced both the Directors’ Stock Plan, which was adopted in 1996, and

the Directors’ Stock Option Plan, which was adopted in 2000. There are 500,000 shares authorized under the 2002 plan.

No further grants or awards may be made under either of the prior plans. Options granted prior to 2003 have a three-year

vesting schedule. Options granted beginning in 2003 become exercisable one year from the date of grant.

Under the Company’s 1994 Stock Purchase Plan, participating employees were able to contribute up to 10 percent

of their annual compensation to acquire shares of common stock at 85 percent of the lower market price on one of two

specified dates in each plan year. Of the 8,000,000 shares of common stock authorized for purchase under this plan, 1,552

participating employees purchased 593,913 shares in 2004. A total of 2,222,089 shares were purchased under this plan.

No further shares may be issued under this plan after June 1, 2004.

When common stock is issued under these plans, the proceeds from options exercised or shares purchased are credited

to common stock to the extent of the par value of the shares issued and the excess is credited to additional paid-in capital.

When treasury common stock is issued, the difference between the average cost of treasury stock used and the proceeds

from options exercised or shares awarded or purchased is charged or credited, as appropriate, to either additional paid-in

capital or retained earnings. The tax benefits relating to amounts deductible for federal income tax purposes, which are

not included in income for financial reporting purposes, have been credited to additional paid-in capital.

The fair values of the issuance of the stock-based compensation pursuant to the Company’s various stock option and

purchase plans were estimated at the grant date using a Black-Scholes option-pricing model.

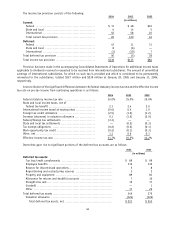

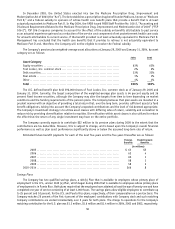

Stock Option Plans Stock Purchase Plan

2004 2003 2002 2004 2003 2002

Weighted-average risk free

rate of interest ...................... 2.57% 2.26% 4.17% 1.33% 1.11% 2.59%

Expected volatility ..................... 33% 37% 42% 32% 31% 35%

Weighted-average expected award life . . 3.7 years 3.4 years 3.5 years .7 years .7 years .7 years

Dividend yield ......................... 1.1% 1.2% 1.2% — — —

Weighted-average fair value ........... $ 6.51 $ 2.90 $ 5.11 $ 11.44 $ 14.15 $ 4.23

51