Foot Locker 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

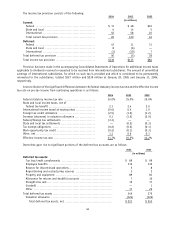

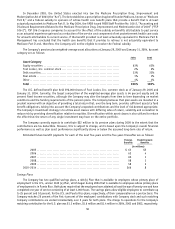

Foreign Currency Exchange Rates

The table below presents the fair value, notional amounts, and weighted-average exchange rates of foreign exchange

forward contracts outstanding at January 29, 2005.

Fair Value

(US in millions)

Contract Value

(US in millions)

Weighted-Average

Exchange Rate

Inventory

Buy e/ Sell British £ ..................................... $ — $ 59 0.6996

Intercompany

Buy e/Sell $US .......................................... $ — $ 6 1.2290

Buy $US/Sell e.......................................... (3) 69 1.2432

Buy e/Sell British £ ..................................... — 17 0.7187

$ (3) $151

Interest Rate Risk Management

The Company has employed interest rate swaps to minimize its exposure to interest rate fluctuations. In 2002, the

Company entered into an interest rate swap agreement with a notional amount of $50 million to receive interest at a fixed

rate of 8.50 percent and pay interest at a variable 6-month rate of LIBOR in arrears plus 3.1 percent. During 2003, the

Company entered into two additional swaps to convert an additional $50 million of the 8.50 percent debentures to an

average variable 6-month rate of LIBOR in arrears plus 3.313 percent. These swaps, which mature in 2022, have been

designated as a fair value hedge of the changes in fair value of $100 million of the Company’s 8.50 percent debentures

payable in 2022 attributable to changes in interest rates. During July 2004, the Company entered into an additional $100

million of interest rate swaps, designated as cash flow hedges, to effectively convert the interest rate on its existing $100

million swaps from a 6-month variable rate to a 1-month variable rate of LIBOR plus 0.25 percent.

The fair value of the swaps was approximately $2 million at January 29, 2005. The carrying value of the 8.50 percent

debentures was increased by $4 million for the portion of the swaps designated as fair value hedges. Accumulated other

comprehensive loss was decreased by the fair value of $2 million related to the swaps that were designated as cash flow hedges.

The fair value of the swaps, included as an addition to other liabilities, was approximately $1 million at January 31,

2004 and the carrying value of the 8.50 percent debentures was decreased by the corresponding amount.

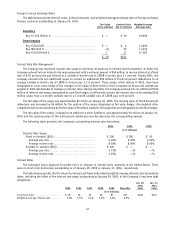

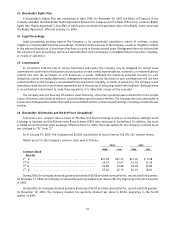

The following table presents the Company’s outstanding interest rate derivatives:

2004 2003 2002

($ in millions)

Interest Rate Swaps:

Fixed to Variable ($US)................................... $ 100 $ 100 $ 50

Average pay rate....................................... 6.46% 5.07% 4.53%

Average receive rate ................................... 8.50% 8.50% 8.50%

Variable to variable ($US) ................................ $ 100 $ — $ —

Average pay rate....................................... 2.73% —% —%

Average receive rate ................................... 3.25% —% —%

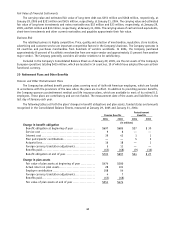

Interest Rates

The Company’s major exposure to market risk is to changes in interest rates, primarily in the United States. There

were no short-term borrowings outstanding as of January 29, 2005 or January 31, 2004, respectively.

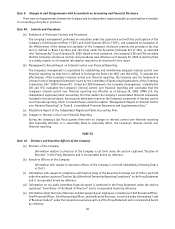

The table below presents the fair value of principal cash flows and related weighted-average interest rates by maturity

dates, including the effect of the interest rate swaps outstanding at January 29, 2005, of the Company’s long-term debt

obligations.

2005 2006 2007 2008 2009 Thereafter

Jan. 29,

2005

Total

Jan. 31,

2004

Total

($ in millions)

Long-term debt ..................... $ 18 18 26 26 87 193 $368 $435

Weighted-average interest rate ....... 5.2% 5.3% 5.4% 5.6% 6.6% 6.9%

47