Foot Locker 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Gross margin as a percentage of sales was 31.0 percent in 2003, an increase of 110 basis points in 2003 from 29.9

percent in 2002. This change primarily reflected a decrease in the cost of merchandise, as a percentage of sales. Increased

vendor allowances improved gross margin, as a percentage of sales, by 28 basis points, year over year.

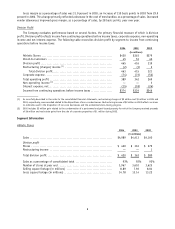

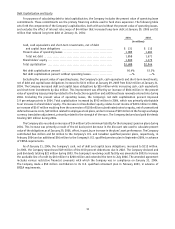

Division Profit

The Company evaluates performance based on several factors, the primary financial measure of which is division

profit. Division profit reflects income from continuing operations before income taxes, corporate expense, non-operating

income and net interest expense. The following table reconciles division profit by segment to income from continuing

operations before income taxes.

2004 2003 2002

(in millions)

Athletic Stores ............................................................ $420 $363 $279

Direct-to-Customers ....................................................... 45 53 40

Division profit ............................................................. 465 416 319

Restructuring (charges) income

(1)

........................................ (2) (1) 2

Total division profit................................................... 463 415 321

Corporate expense ......................................................... (74) (73) (52)

Total operating profit ..................................................... 389 342 269

Non-operating income

(2)

.................................................. — — 3

Interest expense, net ...................................................... (15) (18) (26)

Income from continuing operations before income taxes .................. $374 $324 $246

(1) As more fully described in the notes to the consolidated financial statements, restructuring charges of $2 million and $1 million in 2004 and

2003, respectively, were recorded related to the dispositions of non-core businesses. Restructuring income of $2 million in 2002 reflects revisions

to estimates used in the disposition of non-core businesses and the accelerated store-closing program.

(2) 2002 includes $2 million gain related to the condemnation of a part-owned and part-leased property for which the Company received proceeds

of $6 million and real estate gains from the sale of corporate properties of $1 million during 2002.

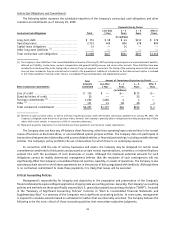

Segment Information

Athletic Stores

2004 2003 2002

(in millions)

Sales ...................................................................... $4,989 $4,413 $4,160

Division profit

Stores ..................................................................... $ 420 $ 363 $ 279

Restructuring income ..................................................... — — 1

Total division profit ....................................................... $ 420 $ 363 $ 280

Sales as a percentage of consolidated total ............................... 93% 92% 92%

Number of stores at year end .............................................. 3,967 3,610 3,625

Selling square footage (in millions) ....................................... 8.89 7.92 8.04

Gross square footage (in millions) ......................................... 14.78 13.14 13.22

6