Foot Locker 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In accordance with the purchase agreement, $13.7 million of the purchase price was deposited into an escrow account

pending resolution of 15 lease related issues. During 2004, 12 of the issues were resolved and $9.1 million was released

from escrow to the seller and $2.2 million was returned to the Company. Accordingly, this reduced the purchase price and

goodwill by $2.2 million and as of January 29, 2005, $2.4 million remained in escrow.

The Republic of Ireland

On October 18, 2004, the Company purchased 11 stores in the Republic of Ireland from the Champion Sports Group

Limited, an athletic footwear and apparel company. The transaction was effected through a wholly owned subsidiary. The

Company operates these stores under the Foot Locker brand as part of the Athletic Stores segment.

The Company has allocated the purchase price of approximately e13 million (approximately $17 million), inclusive

of $1 million of direct costs related to the acquisition, based, in part, upon internal estimates of cash flows, recoverability

and independent appraisals, and may be revised as more definitive facts and evidence become available. Pro forma effects

of the acquisition have not been presented, as their effects were not significant to the consolidated results of operations.

The allocation of the purchase price is detailed below:

(in millions)

Intangible assets — amortizing .......................................................... $ 2

Intangible assets — non-amortizing ..................................................... 3

Goodwill ................................................................................. 12

Total assets ............................................................................ 17

Other amounts due and payable

(1)

....................................................... (1)

Cash paid as of January 29, 2005 ........................................................ $16

(1) “Other amounts due and payable” includes professional fees related to the transaction.

3 Goodwill

The carrying value of goodwill related to the Athletic Stores segment was $191 million at January 29, 2005 and $56

million at January 31, 2004. The carrying value of goodwill related to the Direct-to-Customers segment was $80 million

at January 29, 2005 and January 31, 2004.

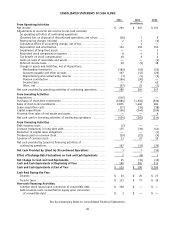

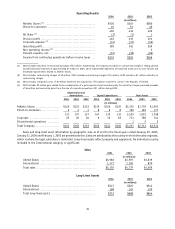

Jan. 31, 2004 Acquisitions

(1)

Additions Other

(2)

Jan. 29, 2005

(in millions)

Goodwill ......................................... $136 134 — 1 $271

(1) Attributable to the acquisition of 349 Footaction stores and 11 stores in the Republic of Ireland.

(2) Includes effect of foreign currency translation.

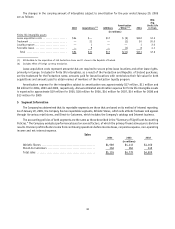

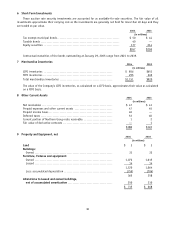

4 Intangible Assets, net

2004 2003

(in millions)

Intangible assets not subject to amortization ............................. $ 4 $ 2

Intangible assets subject to amortization (net of accumulated

amortization of $70 and $51, respectively) ............................. 131 94

$135 $96

Intangible assets not subject to amortization at January 29, 2005, include the 11 stores acquired in the Republic

of Ireland of $3 million related to the trademark. The minimum pension liability required at January 29, 2005 and

January 31, 2004, which represented the amount by which the accumulated benefit obligation exceeded the fair market

value of U.S. defined benefit plan’s assets, was offset by an intangible asset to the extent of previously unrecognized prior

service costs of $1 million at January 29, 2005 and $2 million at January 31, 2004.

33