Foot Locker 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the Amazon.com website and the Foot Locker brands are featured in the Amazon.com specialty stores for apparel and

accessories and sporting goods. The Company also has an arrangement with the NBA and Amazon.com whereby

Footlocker.com provides the fulfillment services for NBA licensed products sold over the Internet at NBAstore.com and

the NBA store on Amazon.com. In addition, the Company has a marketing agreement with the U.S. Olympic Committee

(USOC) providing the Company with the exclusive rights to sell USOC licensed products through catalogs and via a new

e-commerce site. During the fourth quarter of 2004, the Company entered into an agreement with ESPN for ESPN Shop

— an ESPN-branded direct mail catalog and e-commerce site linked to www.ESPNshop.com, where fans can purchase

athletic footwear, apparel and equipment which will be managed by Footlocker.com. Both the catalog and the e-commerce

site feature a variety of ESPN-branded and non-ESPN-branded athletically inspired merchandise.

Executive Summary

The Company reported income from continuing operations for the year ended January 29, 2005 of $255 million, or

$1.64 per diluted share, an increase of 22 percent as compared with 2003. Net income for the year ended January 29,

2005 increased to $293 million, or $1.88 per diluted share, and includes $0.24 per diluted share from discontinued

operations. Earnings per share of $0.24 or $38 million in discontinued operations reflects the resolution of U.S. income

tax examinations of $37 million, as well as income of $1 million related to a refund of custom duties related to certain

of the businesses that comprised the Specialty Footwear segment.

Sales

All references to comparable-store sales for a given period relate to sales of stores that are open at the period-end

and that have been open for more than one year and exclude the effect of foreign currency fluctuations. Accordingly, stores

opened and closed during the period are not included. Sales from the Direct-to-Customer segment are included in the

calculation of comparable-store sales for all periods presented. All references to comparable-store sales for 2004 exclude

the acquisition of the 349 Footaction stores and the 11 stores purchased in the Republic of Ireland. Sales from acquired

businesses that include the purchase of inventory will be included in the computation of comparable-store sales after 15

months of operations. Accordingly, Footaction sales will be included in the computation of comparable-store sales

beginning in August 2005.

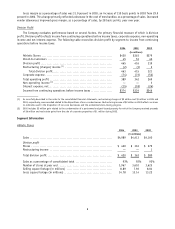

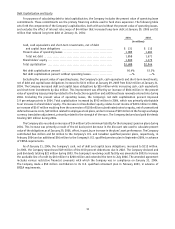

The following table summarizes sales by segment:

2004 2003 2002

(in millions)

Athletic Stores ............................................. $4,989 $4,413 $4,160

Direct-to-Customers ........................................ 366 366 349

$5,355 $4,779 $4,509

Sales of $5,355 million in 2004 increased by 12.1 percent from sales of $4,779 million in 2003. Excluding the effect

of foreign currency fluctuations, sales increased by 9.8 percent as compared with 2003, primarily as a result of the

Company’s acquisition of 349 Footaction stores in May 2004 and the acquisition of 11 stores in the Republic of Ireland

in late October 2004, which accounted for $332 million and $5 million in sales, respectively, for 2004. Comparable-store

sales increased by 0.9 percent. The remaining increase is a result of the Company’s continuation of the new store-opening

program.

Sales of $4,779 million in 2003 increased by 6.0 percent from sales of $4,509 million in 2002. Excluding the effect

of foreign currency fluctuations, sales increased by 2.2 percent as compared with 2002, primarily as a result of the

Company’s continuation of the new store-opening program. Comparable-store sales decreased by 0.5 percent.

Gross Margin

Gross margin as a percentage of sales was 30.5 percent in 2004, decreasing by 50 basis points from 31.0 percent

in 2003. Of the 50 basis points decrease in 2004, approximately 60 basis points is the result of the Footaction chain, offset,

in part, by a decrease in the cost of merchandise. The effect of vendor allowances on gross margin, as a percentage of

sales, as compared with the corresponding prior year period was not significant.

5