Foot Locker 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

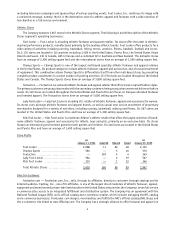

Net cash used in investing activities of the Company’s continuing operations was $265 million in 2003 compared

with $314 million in 2002. Capital expenditures of $144 million in 2003 and $150 million in 2002 primarily related to

store remodelings and new stores. The Company’s purchase of short-term investments, net of sales, increased by $106

million in 2003 as compared with an increase of $152 million in 2002. Lease acquisition costs were $15 million and $18

million in 2003 and 2002, respectively. Proceeds from the disposal of real estate of $6 million in 2002 primarily related

to the condemnation of a part-owned and part-leased property.

Net cash provided by financing activities of continuing operations was $167 million in 2004 as compared with net

cash used of $13 million in 2003. The Company elected to finance a portion of the purchase price of the Footaction stores,

and on May 19, 2004 obtained a 5-year, $175 million term loan from the bank group participating in its existing revolving

credit facility. Concurrent with obtaining the term loan, the Company amended and extended the revolving credit facility

to expire in 2009. Financing fees paid for both the term loan and the revolving credit facility amounted to $2 million.

The Company repurchased $19 million of its 8.50 percent debentures that are due in 2022 during 2003. The Company

declared and paid dividends totaling $39 million in 2004 and $21 million in 2003. During 2004 and 2003, the Company

received proceeds from the issuance of common stock in connection with employee stock programs of $33 million and

$27 million, respectively.

Net cash used in financing activities of continuing operations was $13 million in 2003 compared with $36 million

in 2002. The Company repurchased $19 million of its 8.50 percent debentures that are due in 2022 during 2003. During

2002, the Company repaid the remaining $32 million of the $40 million 7.00 percent medium-term notes due in October

2002 and retired approximately $9 million of its 8.50 percent debentures. The Company declared and paid dividends,

totaling $21 million for the year. During 2002, the Company declared and paid a dividend during the fourth quarter of

$0.03 per share totaling $4 million. During 2003 and 2002, the Company received proceeds from the issuance of common

stock in connection with employee stock programs of $27 million and $10 million, respectively.

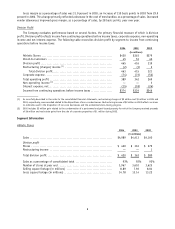

Net cash provided by and used in discontinued operations includes losses from discontinued operations, changes

in assets and liabilities of the discontinued segments and disposition activity related to the reserves. Net cash provided

by discontinued operations was $1 million in 2004 as compared with $7 million in 2003. In 2003, net cash provided

by discontinued operations was $7 million and primarily related to an income tax benefit of $21 million offset, in part,

by payments against related reserves of $13 million. In 2002, discontinued operations utilized cash of $10 million

which consisted of payments for the Northern Group’s operations and disposition activity related to the other

discontinued segments.

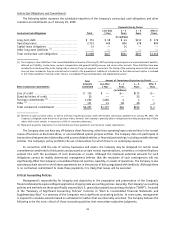

Capital Structure

During 2004, the Company obtained a 5-year, $175 million term loan to finance a portion of the purchase price of

the Footaction stores. Concurrent with the financing of a portion of the Footaction acquisition, the Company amended

its revolving credit agreement, thereby, extending the maturity date to May 2009 from July 2006. On January 31, 2005,

the Company prepaid the first principal payment of $18 million which would have been due in May 2005. The agreement

includes various restrictive financial covenants with which the Company was in compliance on January 29, 2005.

Additionally in 2004, the Company notified The Bank of New York, as Trustee under the indenture, that it intended

to redeem its entire $150 million outstanding 5.50 percent convertible subordinated notes. Effective June 4, 2004, all

of the convertible subordinated notes were cancelled and approximately 9.5 million new shares of the Company’s common

stock were issued. The Company reclassified the remaining $3 million of unamortized deferred costs related to the original

issuance of the convertible debt to equity as a result of the conversion.

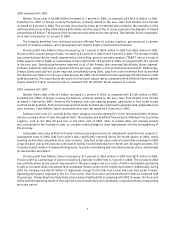

During 2003, the Company primarily focused on repurchasing the 8.50 percent debt, which matures in 2022 in

addition to declaring and paying dividends. During the fourth quarters of each year, the Company increased the quarterly

cash dividends paid. During 2003, the Company paid dividends of $0.03 per share in the first three quarters and increased

the payments to $0.06 in the fourth quarter. During 2004, the Company paid cash dividends of $0.06 per share for each

of the first three quarters and increased the payments to $0.075 per share in the fourth quarter, to an annualized rate

of $0.30 per share.

Credit Rating

The Company’s corporate credit rating from Standard & Poor’s is BB+ and Ba1 from Moody’s Investors Service.

12