Foot Locker 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

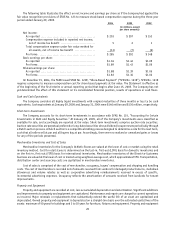

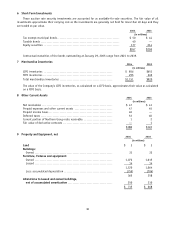

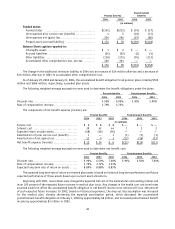

Maturities of long-term debt and minimum rent payments under capital leases in future periods are:

Long-Term

Debt

Capital

Leases Total

(in millions)

2005 ................................................................ $ 18 $— $ 18

2006 ................................................................ 18 — 18

2007................................................................. 26 14 40

2008 ................................................................ 26 — 26

2009 ................................................................ 87 — 87

Thereafter ........................................................... 176 — 176

351 14 365

Less: Current portion ............................................... 18 — 18

$333 $14 $347

Interest expense related to long-term debt and capital lease obligations, including the amortization of the associated

debt issuance costs, was $19 million in 2004, $22 million in 2003 and $28 million in 2002.

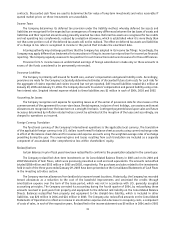

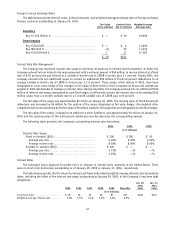

14 Leases

The Company is obligated under operating leases for almost all of its store properties. Some of the store leases contain

purchase or renewal options with varying terms and conditions. Management expects that in the normal course of business,

expiring leases will generally be renewed or, upon making a decision to relocate, replaced by leases on other premises.

Operating lease periods generally range from 5 to 10 years. Certain leases provide for additional rent payments based on

a percentage of store sales. Rent expense includes real estate taxes, insurance, maintenance, and other costs as required

by some of the Company’s leases. The present value of operating leases is discounted using various interest rates ranging

from 4 percent to 13 percent.

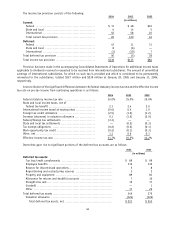

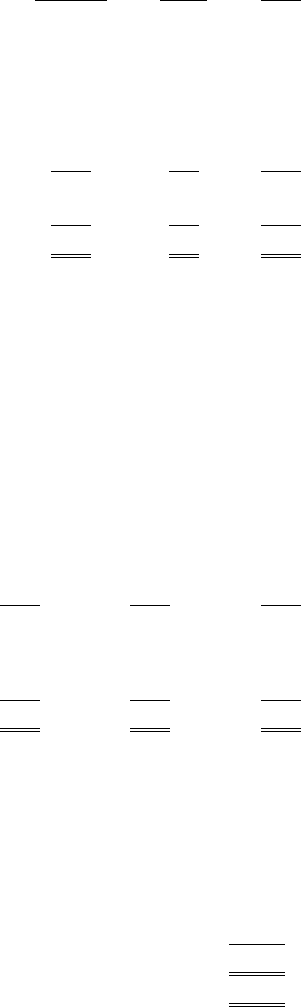

Rent expense consists of the following:

2004 2003 2002

(in millions)

Rent ....................................................... $605 $532 $491

Contingent rent based on sales ............................. 11 11 11

Sublease income ........................................... (1) (1) (1)

Total rent expense ......................................... $615 $542 $501

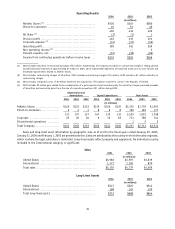

Future minimum lease payments under non-cancelable operating leases are:

(in millions)

2005 ..................................................................................... $ 449

2006 ..................................................................................... 423

2007...................................................................................... 383

2008 ..................................................................................... 322

2009 ..................................................................................... 256

Thereafter ................................................................................ 890

Total operating lease commitments ....................................................... $2,723

Present value of operating lease commitments ........................................... $1,989

39