Foot Locker 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

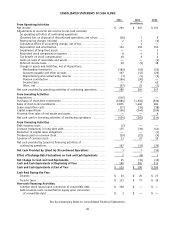

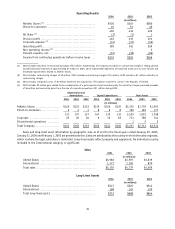

Operating Results

2004 2003 2002

(in millions)

Athletic Stores

(1)

.......................................... $420 $363 $280

Direct-to-Customers ........................................ 45 53 40

465 416 320

All Other

(2)

................................................ (2) (1) 1

Division profit .............................................. 463 415 321

Corporate expense

(3)

...................................... (74) (73) (52)

Operating profit............................................. 389 342 269

Non-operating income

(4)

.................................. — — 3

Interest expense, net ...................................... (15) (18) (26)

Income from continuing operations before income taxes ... $374 $324 $246

(1) 2002 includes reductions in restructuring charges of $1 million. Additionally, the Company recorded non-cash pre-tax charges in selling, general

and administrative expenses of approximately $7 million in 2002, which represented impairment of long-lived assets such as store fixtures and

leasehold improvements related to Athletic Stores.

(2) 2004 includes restructuring charges of $2 million. 2003 includes restructuring charges of $1 million. 2002 includes a $1 million reduction in

restructuring charges.

(3) 2004 includes integration costs of $5 million related to the acquisitions of Footaction and the 11 stores in the Republic of Ireland.

(4) 2002 includes $2 million gain related to the condemnation of a part-owned and part-leased property for which the Company received proceeds

of $6 million and real estate gains from the sale of corporate properties of $1 million during 2002.

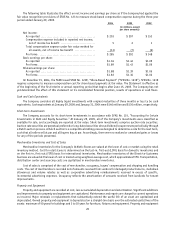

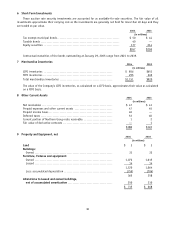

Depreciation and

Amortization Capital Expenditures Total Assets

2004 2003 2002 2004 2003 2002 2004 2003 2002

(in millions)

Athletic Stores .................... $126 $123 $123 $139 $126 $124 $2,335 $1,739 $1,591

Direct-to-Customers ............... 5 4 4 8 6 8 190 183 177

131 127 127 147 132 132 2,525 1,922 1,768

Corporate ......................... 23 25 26 9 12 18 711 789 744

Discontinued operations .......... 1 2 2

Total Company .................... $154 $152 $153 $156 $144 $150 $3,237 $2,713 $2,514

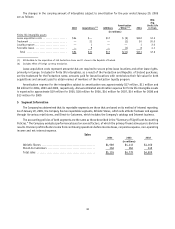

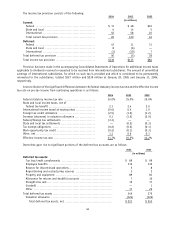

Sales and long-lived asset information by geographic area as of and for the fiscal years ended January 29, 2005,

January 31, 2004 and February 1, 2003 are presented below. Sales are attributed to the country in which the sales originate,

which is where the legal subsidiary is domiciled. Long-lived assets reflect property and equipment. No individual country

included in the International category is significant.

Sales

2004 2003 2002

(in millions)

United States .............................................. $3,982 $3,597 $3,639

International ............................................... 1,373 1,182 870

Total sales ................................................. $5,355 $4,779 $4,509

Long-Lived Assets

2004 2003 2002

(in millions)

United States .............................................. $547 $525 $544

International ............................................... 168 143 120

Total long-lived assets ..................................... $715 $668 $664

35