Foot Locker 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

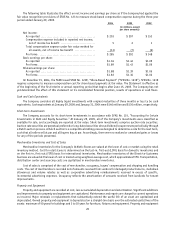

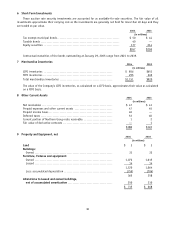

10 Other Assets 2004 2003

(in millions)

Deferred tax costs.......................................................... $ 25 $ 35

Investments and notes receivable.......................................... 22 23

Northern Group note receivable, net of current portion .................... 8 6

Income taxes receivable ................................................... — 1

Fair value of derivative contracts .......................................... 2 —

Other ...................................................................... 47 35

$104 $100

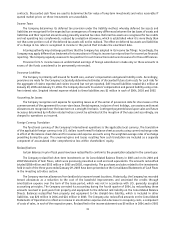

11 Accrued Liabilities

2004 2003

(in millions)

Pension and postretirement benefits ...................................... $ 30 $ 57

Incentive bonuses ......................................................... 34 38

Other payroll and payroll related costs, excluding taxes ................... 51 44

Taxes other than income taxes ............................................ 45 44

Property and equipment ................................................... 22 32

Gift cards and certificates ................................................. 22 16

Income taxes payable ..................................................... 9 9

Fair value of derivative contracts .......................................... 3 3

Current deferred tax liabilities ............................................. 1 —

Other operating costs ..................................................... 58 57

$275 $300

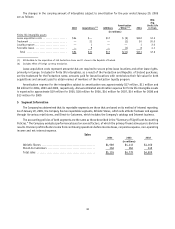

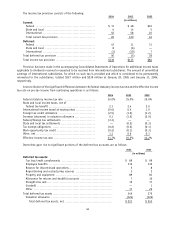

12 Revolving Credit Facility

At January 29, 2005, the Company had unused domestic lines of credit of $175 million, pursuant to a $200 million

unsecured revolving credit agreement. $25 million of the line of credit was committed to support standby letters of credit.

These letters of credit are primarily used for insurance programs.

On May 19, 2004, shortly after the Footaction acquisition, the Company amended its revolving credit agreement,

thereby, extending the maturity date to May 2009 from July 2006. The agreement includes various restrictive financial

covenants with which the Company was in compliance on January 29, 2005. Existing unamortized financing fees as well

as new up-front fees paid, and direct costs incurred, to amend the agreement are amortized over the life of the facility

on a straight-line basis, which is comparable to the interest method, totaling approximately $4 million at January 29,

2005. Interest is determined at the time of borrowing based on variable rates and the Company’s fixed charge coverage

ratio, as defined in the agreement. The rates range from LIBOR plus 1.375 percent to LIBOR plus 2.25 percent. In addition,

the quarterly facility fees paid on the unused portion during 2004, which is also based on the Company’s fixed charge

coverage ratio, ranged from 0.25 percent in the earlier part of 2004 to 0.175 percent by the end of 2004, which was based

on the Company’s third quarter fixed charge coverage ratio. Quarterly facility fees paid in 2003 ranged from 0.50 percent,

in the earlier part, to 0.25 percent during the fourth quarter of 2003, also based on the Company’s improved fixed charge

coverage ratio. There were no short-term borrowings during 2004 or 2003.

Interest expense, including facility fees, related to the revolving credit facility was $2 million in 2004 and $3 million

in both 2003 and 2002.

37