Foot Locker 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As indicated above, as the assignor of the Northern Canada leases, the Company remained secondarily liable under

these leases. As of January 29, 2005, the Company estimates that its gross contingent lease liability is CAD$31 million

(approximately US$25 million). The Company currently estimates the expected value of the lease liability to be

approximately US$1 million. The Company believes that it is unlikely that it would be required to make such

contingent payments.

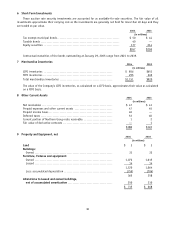

During the third quarter of 2003, a charge in the amount of $1 million before-tax was recorded to cover additional

liabilities related to the exiting of the former leased corporate office in excess of the previous estimate. In the fourth

quarter of 2003, the Company made a CAD$10 million payment (approximately US$7 million) to the landlord, which

released the Company from all future liability related to the lease. Net disposition activity of $13 million in 2002 included

the $18 million reduction in the carrying value of the net assets and liabilities, recognition of the Note of $10 million,

real estate disposition activity of $1 million and severance and other costs of $4 million.

In 1998, the Company exited both its International General Merchandise and Specialty Footwear segments. During

the first quarter of 2004, the Company recorded income of $1 million, after-tax, related to a refund of Canadian customs

duties related to certain of the businesses that comprised the Specialty Footwear segment.

In 1997, the Company exited its Domestic General Merchandise segment. In 2002, the successor-assignee of the

leases of a former business included in the Domestic General Merchandise segment filed a petition in bankruptcy, and

rejected in the bankruptcy proceeding 15 leases it originally acquired from a subsidiary of the Company, two of the actions

brought against this subsidiary remain unresolved as of January 29, 2005. The gross contingent lease liability, related

to these two leases, is approximately $3 million. The Company believes that it may have valid defenses; however, the

outcome of the remaining actions cannot be predicted with any degree of certainty. The Company recorded charges

totaling $4 million related to certain of these actions, as well as others that have been settled, during the second and

fourth quarters of 2003.

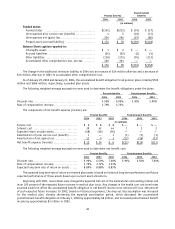

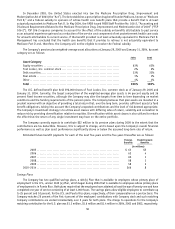

The results of operations and assets and liabilities for the Northern Group segment, the International General

Merchandise segment, the Specialty Footwear segment and the Domestic General Merchandise segment have been

classified as discontinued operations for all periods presented in the Consolidated Statements of Operations and

Consolidated Balance Sheets.

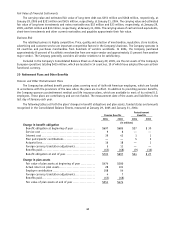

The assets of the discontinued operations consisted primarily of fixed assets related to the Domestic General

Merchandise segment as of January 29, 2005 and as of January 31, 2004. Liabilities of discontinued operations at January

29, 2005 and January 31, 2004, included accounts payable, restructuring reserves and other accrued liabilities related

to the Northern Group and the Domestic General Merchandise segments.

The remaining reserve balances for all of the discontinued segments totaled $18 million as of January 29, 2005,

$7 million of which is expected to be utilized within twelve months and the remaining $11 million thereafter.

41