Foot Locker 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

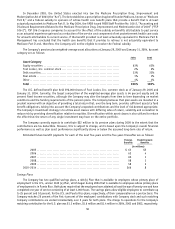

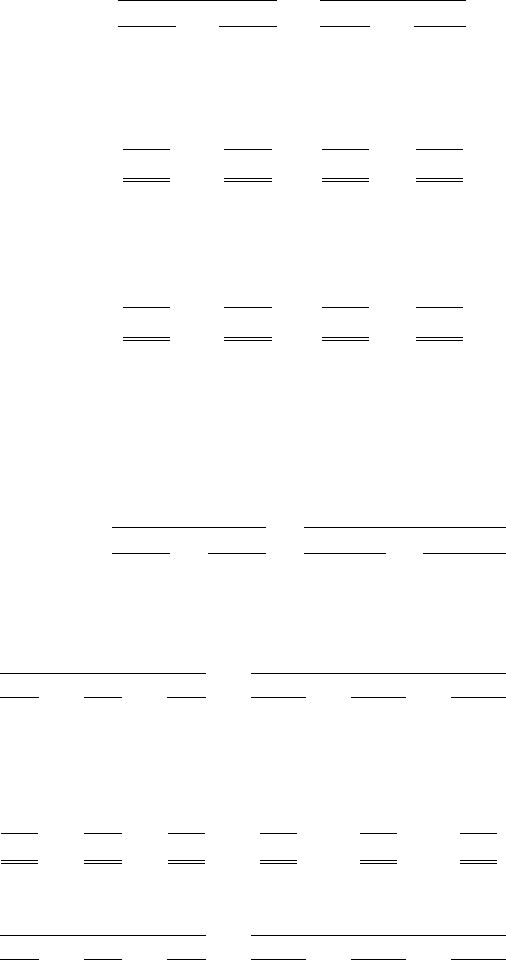

Pension Benefits

Postretirement

Benefits

2004 2003 2004 2003

(in millions)

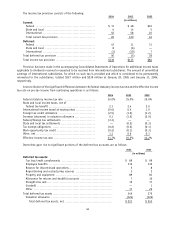

Funded status

Funded status ........................................... $(152) $(223) $ (24) $ (27)

Unrecognized prior service cost (benefit) ................ 4 5 (10) (11)

Unrecognized net (gain) loss ............................. 324 296 (67) (80)

Prepaid asset (accrued liability) ......................... $ 176 $ 78 $(101) $(118)

Balance Sheet caption reported in:

Intangible assets ........................................ $ 1 $ 2 $ — $ —

Accrued liabilities ....................................... (24) (52) (6) (5)

Other liabilities .......................................... (130) (175) (95) (113)

Accumulated other comprehensive loss, pre-tax ......... 329 303 — —

$ 176 $ 78 $(101) $(118)

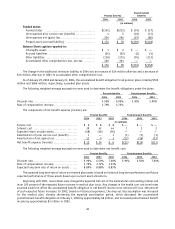

The change in the additional minimum liability in 2004 was an increase of $14 million after-tax and a decrease of

$16 million after-tax in 2003 to accumulated other comprehensive loss.

As of January 29, 2005 and January 31, 2004, the accumulated benefit obligation for all pension plans, totaling $702

million and $696 million, respectively, exceeded plan assets.

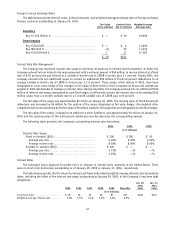

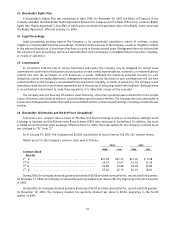

The following weighted-average assumptions were used to determine the benefit obligations under the plans:

Pension Benefits Postretirement Benefits

2004 2003 2004 2003

Discount rate .................................................... 5.50% 5.90% 5.50% 5.90%

Rate of compensation increase .................................. 3.79% 3.72%

The components of net benefit expense (income) are:

Pension Benefits Postretirement Benefits

2004 2003 2002 2004 2003 2002

(in millions)

Service cost ...................................... $ 9 $ 8 $ 8 $ — $ — $ —

Interest cost ..................................... 39 43 44 1 2 2

Expected return on plan assets.................... (48) (46) (50) — — —

Amortization of prior service cost (benefit) ....... 1 — 1 (1) (1) (1)

Amortization of net (gain) loss ................... 11 9 3 (13) (16) (12)

Net benefit expense (income) .................... $ 12 $ 14 $ 6 $(13) $(15) $(11)

The following weighted-average assumptions were used to determine net benefit cost:

Pension Benefits Postretirement Benefits

2004 2003 2002 2004 2003 2002

Discount rate ..................................... 5.90% 6.50% 7.00% 5.90% 6.50% 7.00%

Rate of compensation increase ................... 3.79% 3.72% 3.53%

Expected long-term rate of return on assets ...... 8.89% 8.88% 8.87%

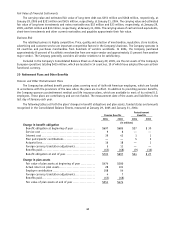

The expected long-term rate of return on invested plan assets is based on historical long-term performance and future

expected performance of those assets based upon current asset allocations.

Beginning with 2001, new retirees were charged the expected full cost of the medical plan and existing retirees will

incur 100 percent of the expected future increase in medical plan costs. Any changes in the health care cost trend rates

assumed would not affect the accumulated benefit obligation or net benefit income since retirees will incur 100 percent

of such expected future increases. In 2002, based on historical experience, the drop out rate assumption was increased

for the medical plan, thereby shortening the expected amortization period, which decreased the accumulated

postretirement benefit obligation at February 1, 2003 by approximately $6 million, and increased postretirement benefit

income by approximately $3 million in 2002.

49