Food Lion 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 // DELHAIZE GROUP FINANCIAL STATEMENTS’12

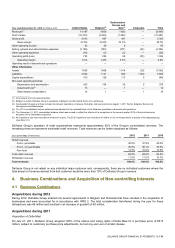

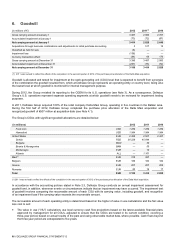

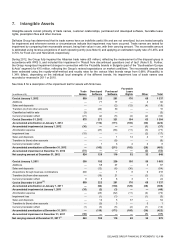

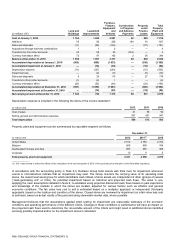

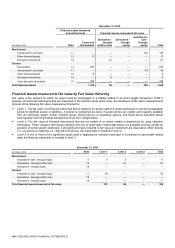

6. Goodwill

(in millions of €)

2012

2011(1)

2010

Gross carrying amount at January 1

3 487

2 900

2 707

Accumulated impairment at January 1

(73)

(72)

(67)

Net carrying amount at January 1

3 414

2 828

2 640

Acquisitions through business combinations and adjustments to initial purchase accounting

3

517

12

Classified as held for sale

(8)

—

—

Impairment loss

(136)

—

—

Currency transaction effect

(84)

69

176

Gross carrying amount at December 31

3 396

3 487

2 900

Accumulated impairment at December 31

(207)

(73)

(72)

Net carrying amount at December 31

3 189

3 414

2 828

_______________

(1) 2011 was revised to reflect the effects of the completion in the second quarter of 2012 of the purchase price allocation of the Delta Maxi acquisition.

Goodwill is allocated and tested for impairment at the cash-generating unit (CGU) level that is expected to benefit from synergies

of the combination the goodwill resulted from, which at Delhaize Group represents an operating entity or country level, being also

the lowest level at which goodwill is monitored for internal management purpose.

During 2012, the Group revisited its reporting to the CODM for its U.S. operations (see Note 3). As a consequence, Delhaize

Group’s U.S. operations represent separate operating segments at which goodwill needs to be reviewed for impairment testing

purposes.

In 2011, Delhaize Group acquired 100% of the retail company Delta Maxi Group, operating in five countries in the Balkan area.

During the first half of 2012, Delhaize Group completed the purchase price allocation of the Delta Maxi acquisition and

recognized goodwill of €507 million at acquisition date (see Note 4.1).

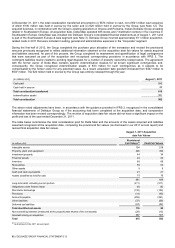

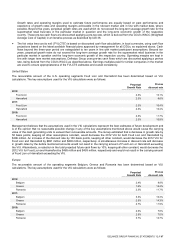

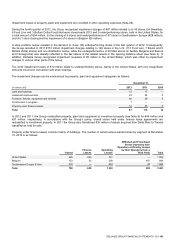

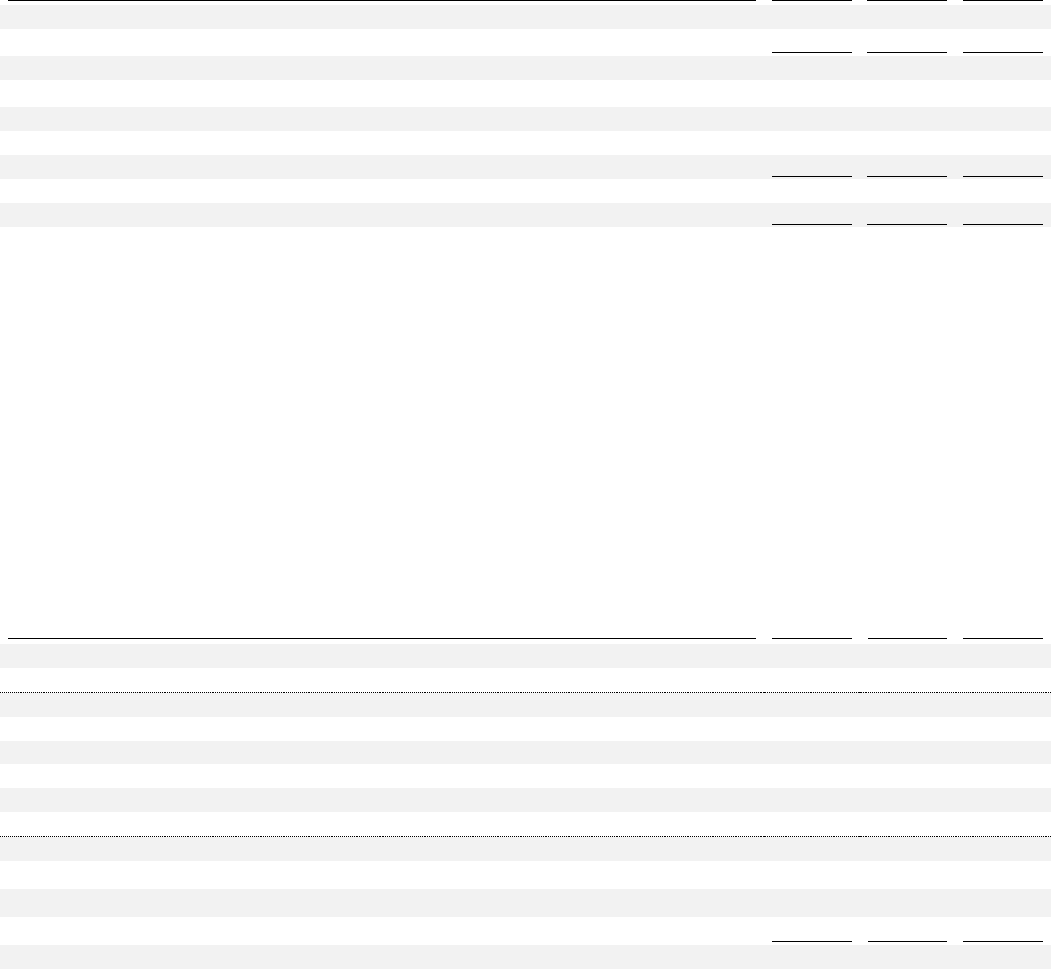

The Group’s CGUs with significant goodwill allocations are detailed below:

(in millions)

2012

2011

2010

Food Lion

USD

1 259

1 259

1 259

Hannaford

USD

1 984

1 984

1 984

United States

EUR

2 458

2 507

2 427

Serbia

RSD

36 228

45 844

—

Bulgaria

BGN

—

30

—

Bosnia & Herzegovina

BAM

—

50

—

Montenegro

EUR

—

10

—

Albania

ALL

—

1 161

—

Maxi(1)

EUR

318

497

—

Belgium

EUR

186

184

182

Greece

EUR

207

207

202

Romania

EUR

20

19

17

Total

EUR

3 189

3 414

2 828

_______________

(1) 2011 was revised to reflect the effects of the completion in the second quarter of 2012 of the purchase price allocation of the Delta Maxi acquisition.

In accordance with the accounting policies stated in Note 2.3, Delhaize Group conducts an annual impairment assessment for

goodwill and, in addition, whenever events or circumstances indicate that an impairment may have occurred. The impairment test

of goodwill involves comparing the recoverable amount of each CGU with its carrying value, including goodwill, and recognition

of an impairment loss if the carrying value exceeds the recoverable amount.

The recoverable amount of each operating entity is determined based on the higher of value in use calculations and the fair value

less cost to sell:

The value in use (“VIU”) calculations use local currency cash flow projections based on the latest available financial plans

approved by management for all CGUs, adjusted to ensure that the CGUs are tested in its current condition, covering a

three-year period, based on actual results of the past and using observable market data, where possible. Cash flows beyond

the three-year period are extrapolated to five years.