Food Lion 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 // DELHAIZE GROUP FINANCIAL STATEMENTS’12

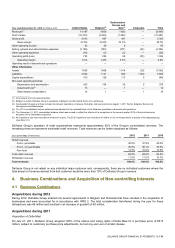

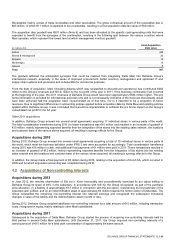

Acquisitions during 2010

On May 18, 2009, Delhaize Group announced the launch of a voluntary tender offer for all of the shares of its Greek subsidiary

Alfa Beta Vassilopoulos S.A. (“Alfa Beta”) which were not yet held by any of the consolidated companies of Delhaize Group at a

price of €30.50 per Alfa Beta share. On June 29, 2009, the offer price was increased to €34.00 per share, based on an

agreement with two major shareholders (approximately 12%) of Alfa Beta. At the end of the acceptance period on July 9, 2009,

Delhaize Group held 89.56% of Alfa Beta shares. During the second half of 2009, Delhaize Group acquired additional shares on

the market and at December 31, 2009 Delhaize Group owned 11 451 109 shares (representing 89.93%).

On March 12, 2010, Delhaize Group launched through its wholly owned Dutch subsidiary Delhaize “The Lion” Nederland BV

(“Delned”) a new tender offer to acquire the remaining shares of Alfa Beta at €35.73 per share.

On June 4, 2010, Delned requested from the Hellenic Capital Market Commission the approval to squeeze-out the remaining

minority shares in Alfa Beta, which was granted on July 8, 2010. The last date of trading Alfa Beta shares at the Athens

Exchange was July 29, 2010 and settlement occurred on August 9, 2010.

Since August 9, 2010, Delhaize Group owns 100% of the voting rights in Alfa Beta, which was delisted from the Athens

Exchange as of October 1, 2010.

The difference between the carrying amount of non-controlling interest (€16 million) and the fair value of the consideration paid

(€47 million), including transactions costs (€1 million), was recognized directly in equity and attributed to the shareholders of the

Group and, therefore, had no impact on goodwill or profit or loss.

5. Divestitures, Disposal Group / Assets Held for Sale and Discontinued

Operations

5.1 Divestitures

On February 14, 2012, Delhaize Group reached a binding agreement to sell Wambacq & Peeters SA, a Belgian transport

company, to Van Moer Group. This transaction did not meet the criteria of a “Discontinued Operation” and was completed on

April 30, 2012.

Delhaize Group received €3 million in cash and recorded a gain on disposal of €1 million in 2012.

No divestitures took place in 2011 and 2010.

5.2 Disposal Group / Assets Classified as Held for Sale

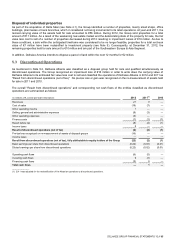

Disposal of Delhaize Albania SHPK

The assets and liabilities related to the Group’s operations in Albania (part of the Southeastern Europe & Asia segment) have

been presented as held for sale following the approval of Delhaize Group’s Board of Directors on December 19, 2012 to sell

Delhaize Albania SHPK. In January 2013, Delhaize Group reached a binding agreement with Balfin SHPK and agreed on a sales

price of €2 million, subject to contractual adjustments. The transaction was completed in February 2013.

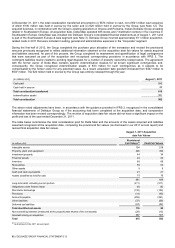

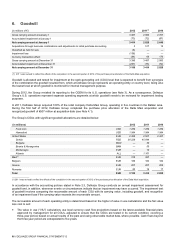

At December 31, 2012, the carrying value of assets classified as assets held for sale and associated liabilities were as follows:

(in millions of EUR)

2012

Property, plant and equipment

1

Inventories

3

Receivables and other current assets

1

Cash and cash equivalents

1

Assets classified as held for sale

6

Less:

Non-current liabilities

(1)

Accounts payable and accrued expenses

(3)

Assets classified as held for sale, net of associated liabilities

2

The Group recognized an impairment loss of €16 million (see also Note 5.3) to write down the carrying value of Delhaize Albania

to its fair value less costs to sell, which includes goodwill impairment charges of approximately €8 million.