Food Lion 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

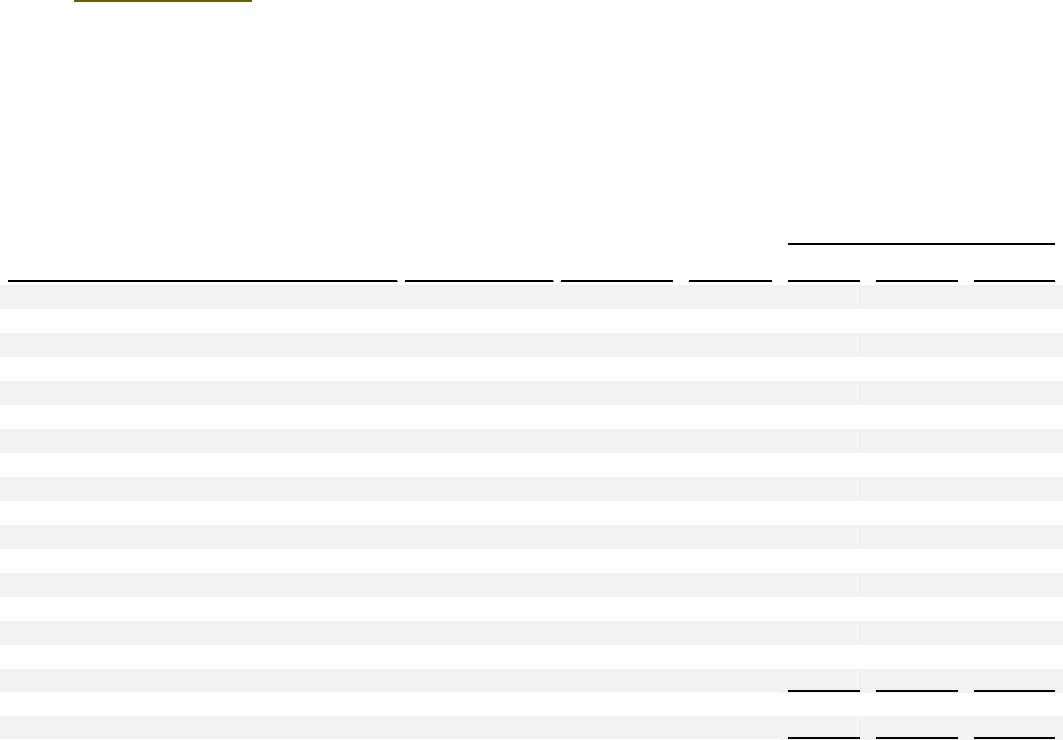

DELHAIZE GROUP FINANCIAL STATEMENTS ’12 // 117

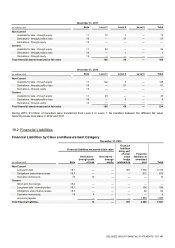

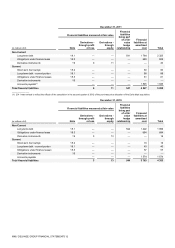

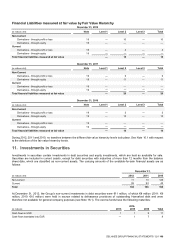

18. Financial Liabilities

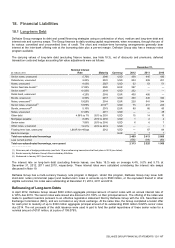

18.1 Long-term Debt

Delhaize Group manages its debt and overall financing strategies using a combination of short, medium and long-term debt and

interest rate and currency swaps. The Group finances its daily working capital requirements, when necessary, through the use of

its various committed and uncommitted lines of credit. The short and medium-term borrowing arrangements generally bear

interest at the inter-bank offering rate at the borrowing date plus a pre-set margin. Delhaize Group also has a treasury notes

program available.

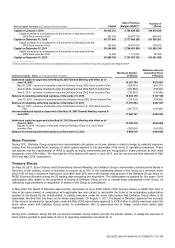

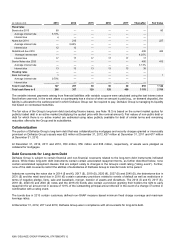

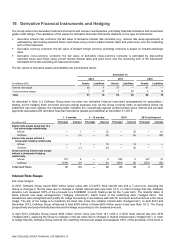

The carrying values of long-term debt (excluding finance leases, see Note 18.3), net of discounts and premiums, deferred

transaction costs and hedge accounting fair value adjustments were as follows:

(in millions of €)

Nominal Interest

Rate

Maturity

Currency

December 31,

2012

2011

2010

Senior notes, unsecured

5.70%

2040

USD

438

445

430

Debentures, unsecured

9.00%

2031

USD

204

208

201

Notes, unsecured

8.05%

2027

USD

52

53

51

Senior fixed rate bonds(1)

3.125%

2020

EUR

397

—

—

Senior notes(1)

4.125%

2019

USD

232

—

—

Retail bond, unsecured

4.25%

2018

EUR

400

400

—

Bonds, unsecured

6.50%

2017

USD

339

345

334

Notes, unsecured(1)

5.625%

2014

EUR

229

541

544

Senior notes, unsecured(1)

5.875%

2014(3)

USD

75

231

223

Bonds, unsecured(2)

5.10%

2013

EUR

80

80

80

Notes, unsecured

8.125%

2011

USD

—

—

38

Other debt

4.58% to 7%

2013 to 2031

USD

15

14

10

Mortgages payable

8.25%

2010 to 2016

USD

1

2

2

Senior notes

7.06%

2010 to 2016

USD

6

6

7

Other notes, unsecured

13.21%

2010 to 2013

USD

—

—

1

Floating term loan, unsecured

LIBOR 6m+45bps

2012

USD

—

87

84

Bank borrowings

EUR

1

1

1

Total non-subordinated borrowings

2 469

2 413

2 006

Less current portion

(156)

(88)

(40)

Total non-subordinated borrowings, non-current

2 313

2 325

1 966

____________________

(1) Notes are part of hedging relationship (see Note 19) and refinancing transactions that took place in 2012 (see below).

(2) Bonds issued by Delhaize Group’s Greek subsidiary Alfa Beta.

(3) Redeemed in January 2013 (see below).

The interest rate on long-term debt (excluding finance leases, see Note 18.3) was on average 4.4%, 5.0% and 5.1% at

December 31, 2012, 2011 and 2010, respectively. These interest rates were calculated considering the interest rate swaps

discussed in Note 19.

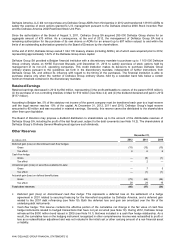

Delhaize Group has a multi-currency treasury note program in Belgium. Under this program, Delhaize Group may issue both

short-term notes (commercial paper) and medium-term notes in amounts up to €500 million, or the equivalent thereof in other

eligible currencies. No notes were outstanding at December 31, 2012, 2011 and 2010.

Refinancing of Long-term Debts

In April 2012, Delhaize Group issued $300 million aggregate principal amount of senior notes with an annual interest rate of

4.125% due 2019. The senior notes were issued at a discount of 0.193% on their principal amount. The offering of the notes was

made to qualified investors pursuant to an effective registration statement filed by Delhaize Group with the U.S. Securities and

Exchange Commission (SEC), and are not listed on any stock exchange. At the same time, the Group completed a tender offer

for cash prior to maturity of up to €300 million aggregate principal amount of its outstanding €500 million 5.625% senior notes

due 2014. The net proceeds of the debt issuance were used in part to fund the partial repurchase of these senior notes for a

nominal amount of €191 million, at a price of 108.079%.