Food Lion 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 //

REVIEW

FINANCIAL REVIEW

Income Statement

In 2012, Delhaize Group achieved

revenues of €22.7 billion. This

represents an increase of 7.7% at

actual exchange rates, mainly due

to the strengthening of the U.S. dol-

lar by 8.3% against the euro com-

pared to 2011, or 2.9% at identical

exchange rates. Organic revenue

growth was 2.1%.

The revenue growth was the result

of the performance of all segments.

In the U.S. revenue growth was

0.9% in local currency, excluding

the impact of the 126 stores closed

in the fi rst quarter of 2012. Revenue

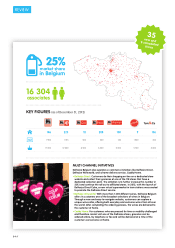

growth in Belgium was 1.6% as a

result of network growth and com-

parable store sales growth of 0.6%.

Finally, Southeastern Europe & Asia

delivered a solid revenue growth of

34.1% at identical exchange rates

following the acquisition of the

Maxi operations in 2011 (+10.0% at

identical exchange rates excluding

Maxi) and the strong performance

in Greece and Romania.

The U.S. operating companies gen-

erated 64% of Group revenues,

Belgium 22% and Southeastern

Europe and Asia 14%. Gross mar-

gin was 24.5% of revenues, a

102 basis points decrease at iden-

tical exchange rates due to price

investments across the Group. The

lower margin of our Maxi business

also contributed to the decreased

gross margin.

Other operating income was

€122 million, an increase of €4 mil-

lion compared to last year.

Selling, general and adminis-

trative expenses were 21.4% of

revenues and were fl at at identi-

cal exchange rates as expenses

related to our strategic initiatives

in the U.S. and salary indexations

in Belgium were offset by cost sav-

ings across the Group, a payroll

tax refund in Belgium related to the

prior year and the reduction of our

U.S. bonus accrual.

Other operating expenses were

€428 million compared to €169 mil-

lion last year primarily due to a

€125 million charge linked to the

portfolio optimization announced

in January 2012 and a €270 mil-

lion impairment charge recorded in

the fourth quarter of 2012, mostly

related to Maxi, and to a lesser

extent to planned Sweetbay store

closures.

Operating profi t decreased by

52% at actual exchange rates

to €390 million mainly due to

price investments, store closing

expenses of €125 million in the fi rst

quarter of 2012 and the impairment

charges of €270 million recorded in

the fourth quarter of 2012.

Underlying operating profi t

decreased by 13.4% at actual

exchange rates to €810 millions.

Net fi nancial expenses were

€241 million, an increase of

€50 million at identical exchange

rates mainly due to the premiums

paid as part of the debt refi nanc-

ing at the end of 2012 and to the

additional debt to partially fi nance

the Maxi acquisition. At the end of

2012, the average interest rate on

our long-term debt was 4.4% com-

pared to 5.0% at the end of 2011.

Net profi t from continuing opera-

tions decreased by 73.7% (-78.9%

at identical exchange rates) as a

result of the portfolio optimiza-

tion charge in the fi rst quarter, the

impairment charge in the fourth

quarter and a decline in operating

profi t which was partially offset by

the resolution of tax matters and

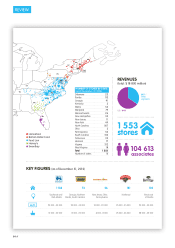

REVENUES

(in billions of €)

10

20.8

11

21.1

12

22.7

OPERATING MARGIN

(in %)

10

4.9

11

3.9

12

1.7

OPERATING PROFIT

(in millions of €)

10

1 024

11

813

12

390

NET PROFIT FROM

CONTINUING OPERATIONS

(in millions of €)

10

576

11

477

12

125