Food Lion 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114 // DELHAIZE GROUP FINANCIAL STATEMENTS’12

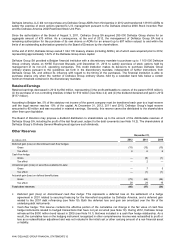

Delhaize America, LLC did not repurchase any Delhaize Group ADRs from third parties in 2012 and transferred 139 813 ADRs to

satisfy the exercise of stock options granted to U.S. management pursuant to the Delhaize America 2000 Stock Incentive Plan

and the Delhaize America 2002 Restricted Stock Unit Plan.

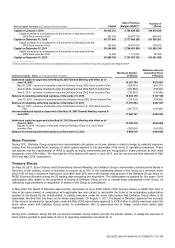

Since the authorization of the Board of August 3, 2011, Delhaize Group SA acquired 285 000 Delhaize Group shares for an

aggregate amount of €13 million. As a consequence, at the end of 2012, the management of Delhaize Group SA had a

remaining authorization for the purchase of its own shares or ADRs for an amount up to €87 million subject to and within the

limits of an outstanding authorization granted to the Board of Directors by the shareholders.

At the end of 2012, Delhaize Group owned 1 044 135 treasury shares (including ADRs), all of which were acquired prior to 2012,

representing approximately 1.02% of the Delhaize Group share capital.

Delhaize Group SA provided a Belgian financial institution with a discretionary mandate to purchase up to 1 100 000 Delhaize

Group ordinary shares on NYSE Euronext Brussels until December 31, 2013 to satisfy exercises of stock options held by

management of its non-U.S. operating companies. This credit institution makes its decisions to purchase Delhaize Group

ordinary shares pursuant to the guidelines set forth in the discretionary mandate, independent of further instructions from

Delhaize Group SA, and without its influence with regard to the timing of the purchases. The financial institution is able to

purchase shares only when the number of Delhaize Group ordinary shares held by a custodian bank falls below a certain

minimum threshold contained in the discretionary mandate.

Retained Earnings

Retained earnings decreased in 2012 by €82 million, representing (i) the profit attributable to owners of the parent (€105 million),

(ii) the purchase of non-controlling interests in Maxi for €10 million (see Note 4.2) and (iii) the dividend declared and paid in 2012

(€177 million).

According to Belgian law, 5% of the statutory net income of the parent company must be transferred each year to a legal reserve

until the legal reserve reaches 10% of the capital. At December 31, 2012, 2011 and 2010, Delhaize Group’s legal reserve

amounted to €5 million and was recorded in retained earnings. Generally, this reserve cannot be distributed to the shareholders

other than upon liquidation.

The Board of Directors may propose a dividend distribution to shareholders up to the amount of the distributable reserves of

Delhaize Group SA, including the profit of the last fiscal year, subject to the debt covenants (see Note 18.2). The shareholders at

Delhaize Group’s Ordinary General Meeting must approve such dividends.

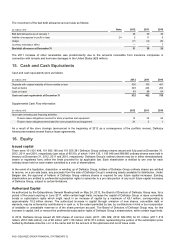

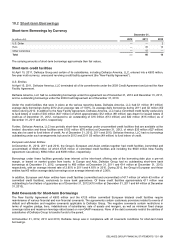

Other Reserves

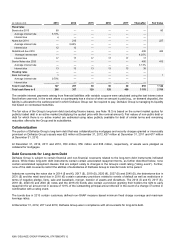

(in millions of €)

December 31,

2012

2011

2010

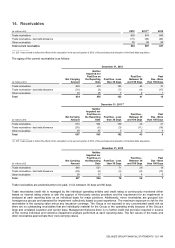

Deferred gain (loss) on discontinued cash flow hedges:

Gross

(15)

(15)

(15)

Tax effect

6

6

6

Cash flow hedge:

Gross

—

(6)

(1)

Tax effect

—

2

—

Unrealized gain (loss) on securities available-for-sale:

Gross

—

7

5

Tax effect

—

(1)

(1)

Actuarial gain (loss) on defined benefit plans:

Gross

(79)

(64)

(44)

Tax effect

28

24

16

Total other reserves

(60)

(47)

(34)

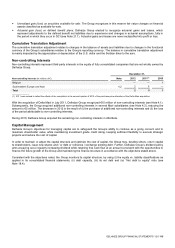

Deferred gain (loss) on discontinued cash flow hedge: This represents a deferred loss on the settlement of a hedge

agreement in 2001 related to securing financing for the Hannaford acquisition by Delhaize America, and a deferred gain

related to the 2007 debt refinancing (see Note 19). Both the deferred loss and gain are amortized over the life of the

underlying debt instruments.

Cash flow hedge: This reserve contains the effective portion of the cumulative net change in the fair value of cash flow

hedge instruments related to hedged transactions that have not yet occurred (see Note 19). During 2012, Delhaize Group

refinanced the $300 million bond issued in 2009 (see Note 18.1) that was included in a cash flow hedge relationship. As a

result, the cumulative loss on the hedging instrument recognized in other comprehensive income was reclassified to profit or

loss as a reclassification adjustment and was not included in the initial cost or other carrying amount of a non-financial asset

or liability.