Food Lion 2012 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140 // DELHAIZE GROUP FINANCIAL STATEMENTS’12

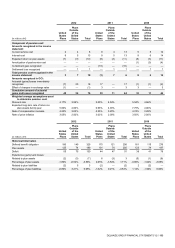

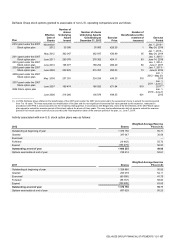

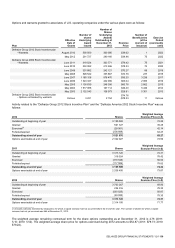

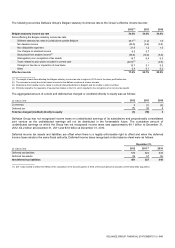

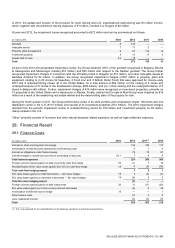

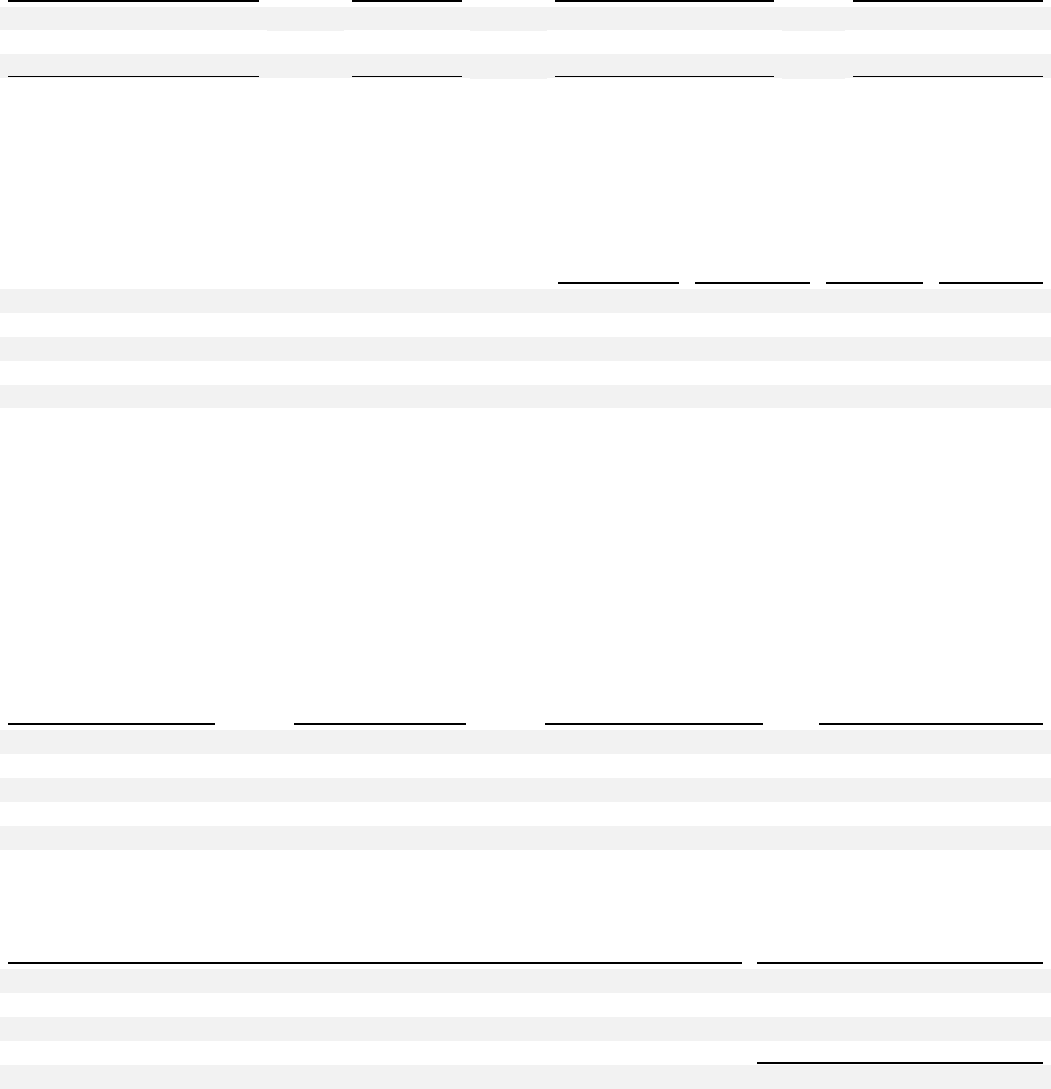

The following table summarizes options and warrants outstanding as of December 31, 2012, and the related weighted average

remaining contractual life (years) and weighted average exercise price under the stock option plans for associates of U.S.

operating companies:

Range of Exercise Prices

Number

Outstanding

Weighted Average

Remaining Contractual Life

(in years)

Weighted Average

Exercise Price

(in $)

$28.91 - $46.40

856 245

6.40

39.33

$60.76 - $74.76

1 270 623

3.52

67.08

$78.33 - $96.30

1 395 008

4.89

89.64

$28.91 - $96.30

3 521 876

4.76

69.27

Options exercisable at the end of 2012 had a weighted average remaining contractual term of 3.60 years (2011: 4.40; 2010:

4.90).

The fair values of options granted were $5.89 (August 2012), $6.10 (May 2012), $12.61 and $13.03 per option for the years

2012, 2011 and 2010, respectively, and were estimated using the following weighted average assumptions:

August 2012

May 2012

2011

2010

Share price (in $)

39.62

38.86

78.42

78.33

Expected dividend yield (%)

3.6

3.5

2.9

2.5

Expected volatility (%)

27.1

27.9

26.0

25.2

Risk-free interest rate (%)

0.5

0.6

1.2

1.6

Expected term (years)

4.2

4.2

4.0

4.0

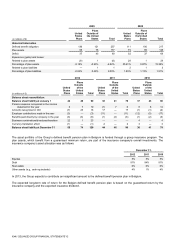

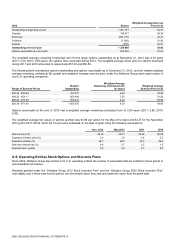

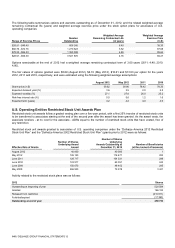

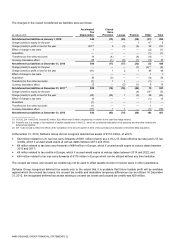

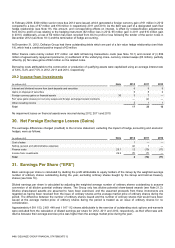

U.S. Operating Entities Restricted Stock Unit Awards Plan

Restricted stock unit awards follow a graded vesting plan over a five-year period, with a first 25% tranche of restricted stock units

to be transferred to associates starting at the end of the second year after the award has been granted. As the award vests, the

associate receives - at no cost for the associate - ADRs equal to the number of restricted stock units that have vested, free of

any restriction.

Restricted stock unit awards granted to associates of U.S. operating companies under the “Delhaize America 2012 Restricted

Stock Unit Plan” and the “Delhaize America 2002 Restricted Stock Unit Plan” (grants prior to 2012) were as follows:

Effective Date of Grants

Number of Shares

Underlying Award

Issued

Number of Shares

Underlying

Awards Outstanding at

December 31, 2012

Number of Beneficiaries

(at the moment of issuance)

August 2012

40 000

40 000

1

May 2012

126 123

116 671

253

June 2011

128 717

104 331

249

June 2010

123 917

69 351

243

June 2009

150 073

48 402

245

May 2008

466 503

79 978

3 421

Activity related to the restricted stock plans was as follows:

2012

Shares

Outstanding at beginning of year

520 584

Granted

166 123

Released from restriction

(210 611)

Forfeited/expired

(17 363)

Outstanding at end of year

458 733