Food Lion 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP ANNUAL REPORT ‘12 // 7

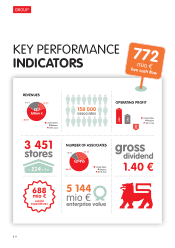

+ 224 new stores

PIERRE-OLIVIER BECKERS

CEO DELHAIZE GROUP

Simplifi cation and cost aware-

ness is really becoming everyone’s

focus. Because retail is detail, we

need to turn every penny twice

before we spend it and when we

spend it, it has to benefi t both the

customer and the company.

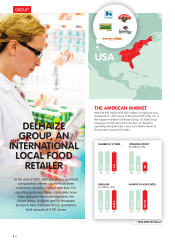

have adapted and we will continue

to invest in price, in assortment and

in our stores. We are serious about

stepping up our efforts in the U.S. This

is also demonstrated by the appoint-

ment of Roland Smith as the new CEO

for Delhaize America. He took over

from Ron Hodge who retired at the

end of the year after successfully cre-

ating the Delhaize America structure

and initiating the Food Lion reposi-

tioning. Roland came on board with

energy and determination to further

build and accelerate our efforts in

order to solidify and secure the future

of the operations in the U.S.

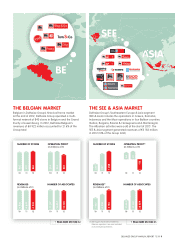

Looking at the evolution of the

market share in Belgium, it looks

like your historic base could also

use some attention.

POB:

When we look at the market

share trend in Belgium, it is obvious

that we can do better and, of course,

have that ambition. There are a num-

ber of elements to explain this evolu-

tion. The current economic crisis and

waning consumer confi dence are in

the advantage of the so-called price

players in the market. On top of that,

some of our competitors found trac-

tion again and new competitors

entered the market. So yes, the bat-

tleground has changed and we lost

some ground. But we know we have

the tools and the people, to regain

what we have lost. Over the last years,

we have invested heavily in the back

offi ce, now we will focus more on our

network and on our product offering.

Delhaize in Belgium has always been

recognized as a food innovator offer-

ing unique products and service. It will

be our goal in the months and years

to come to make these points of dif-

ferentiation stronger than ever before.

While Delhaize Group seems

to have diffi culties in its mature

markets, with the portfolio in

Southeastern Europe it clearly

has a winning hand.

POB:

The performance of our newer

operations and formats, like South-

eastern Europe, Indonesia, Red

Market in Belgium and Bottom Dol-

lar Food in the U.S., was without any

doubt one of the bright spots in 2012.

In Romania, we opened at an incred-

ible speed 89 new stores in 2012 and

in Indonesia Super Indo celebrated

the opening of its 100th store. As was

the case last year, our operations in

Greece weathered the tough eco-

nomic conditions in the country well.

Alfa Beta succeeded again in market

share growth thanks to the consistent

implementation of its strategy, based

on low prices and affordable private

brand alternatives. Of course we are

satisfi ed with this performance, but

we nevertheless stay vigilant with

regards to the future of the country

within the Euro zone. Not being pre-

pared would be irresponsible.

Looking forward, what are

the key priorities for 2013?

MJ:

I have had signifi cant experience

navigating through rough waters. The

most important lesson I have learned

from those experiences is that an

organization has to be focused on a

limited number of high impact priori-

ties. Speed and impeccable execution

will be required to win the hearts and

the wallets of the customers and to

keep you in the game. And as I said

before, the overall priority is to con-

tinue to deliver on this strategy and

increase the value for both our cus-

tomers and our shareholders.

POB:

In 2013, more than ever before,

our focus will be on accelerating

revenue growth and on value crea-

tion. Further price investments, selec-

tive store openings and comparable

store sales growth should result in

an increased top line while a ruthless

discipline in our capital allocation in

combination with a new strategic cost

plan and focus on free cash fl ow gen-

eration should result in value creation.

By delivering on these two key priori-

ties we will not only reach the other

side of the river, will be well positioned

far beyond 2013.

62%

of all Food

Lion stores

repositioned