Food Lion 2012 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP FINANCIAL STATEMENTS’12 // 149

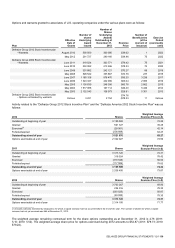

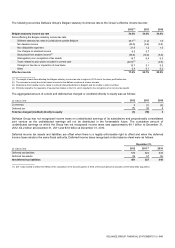

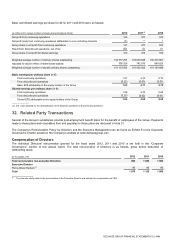

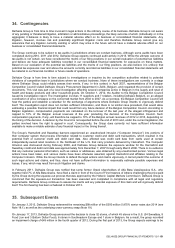

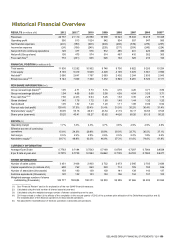

Basic and diluted earnings per share for 2012, 2011 and 2010 were as follows:

(in millions of €, except numbers of shares and earnings per share)

2012

2011(1)

2010

Net profit from continuing operations

125

477

576

Net profit (loss) from continuing operations attributable to non-controlling interests

(2)

—

1

Group share in net profit from continuing operations

127

477

575

Result from discontinued operations, net of tax

(22)

(2)

(1)

Group share in net profit for diluted earnings

105

475

574

Weighted average number of ordinary shares outstanding

100 777 257

100 683 828

100 270 861

Adjusted for dilutive effect of share-based awards

356 326

742 075

888 825

Weighted average number of diluted ordinary shares outstanding

101 133 583

101 425 903

101 159 686

Basic earnings per ordinary share (in €):

From continuing operations

1.27

4.74

5.74

From discontinued operations

(0.22)

(0.03)

(0.01)

Basic EPS attributable to the equity holders of the Group

1.05

4.71

5.73

Diluted earnings per ordinary share (in €):

From continuing operations

1.26

4.70

5.69

From discontinued operations

(0.22)

(0.02)

(0.01)

Diluted EPS attributable to the equity holders of the Group

1.04

4.68

5.68

_______________

(1) 2011 was adjusted for the reclassification of the Albanian operations to discontinued operations..

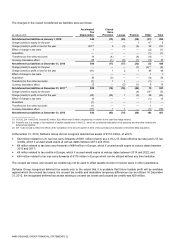

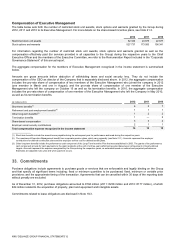

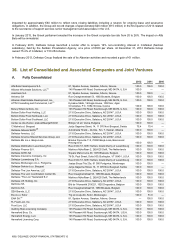

32. Related Party Transactions

Several of the Group’s subsidiaries provide post-employment benefit plans for the benefit of employees of the Group. Payments

made to these plans and receivables from and payables to these plans are disclosed in Note 21.

The Company’s Remuneration Policy for Directors and the Executive Management can be found as Exhibit E to the Corporate

Governance Charter posted on the Company’s website at www.delhaizegroup.com.

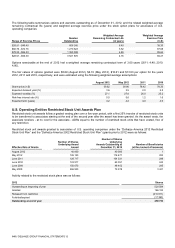

Compensation of Directors

The individual Directors’ remuneration granted for the fiscal years 2012, 2011 and 2010 is set forth in the “Corporate

Governance” section of this annual report. The total remuneration of Directors is as follows, gross before deduction of

withholding taxes:

(in thousands of €)

2012

2011

2010

Total remuneration non-executive Directors

998

1 049

1 000

Executive Director

Pierre-Olivier Beckers(1)

80

80

80

Total

1 078

1 129

1 080

(1) The amounts solely relate to the remuneration of the Executive Director and exclude his compensation as CEO.