Food Lion 2012 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2012 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

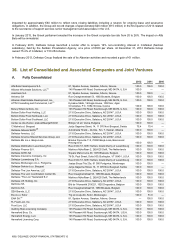

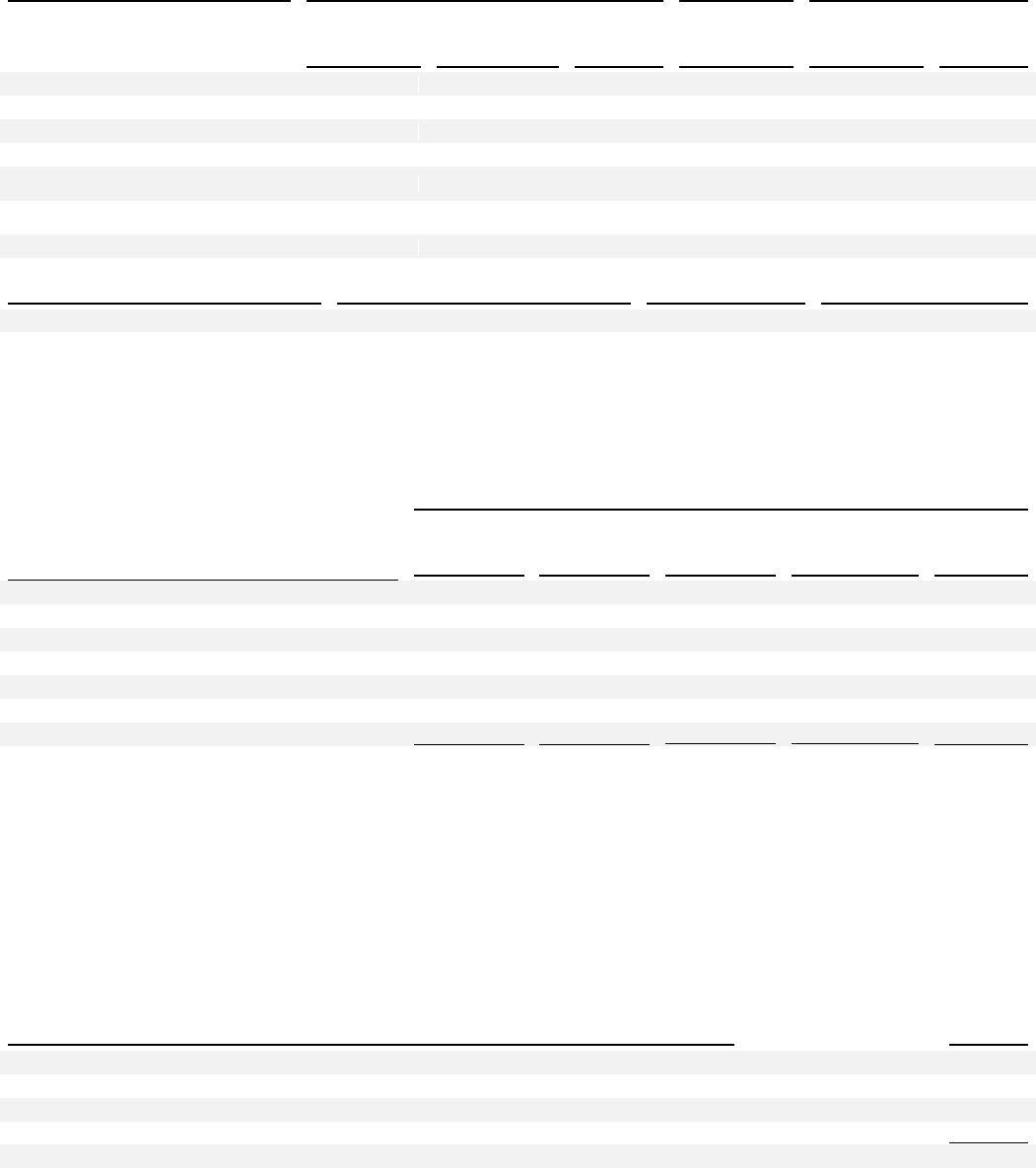

158 // DELHAIZE GROUP FINANCIAL STATEMENTS’12

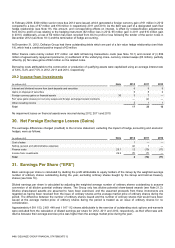

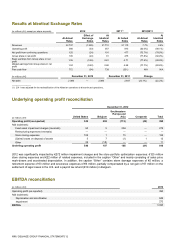

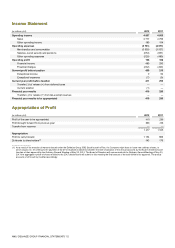

Results at Identical Exchange Rates

(in millions of €, except per share amounts)

2012

2011(1)

2012/2011

At Actual

Rates

Effect of

Exchange

Rates

At

Identical

Rates

At Actual

Rates

At Actual

Rates

At

Identical

Rates

Revenues

22 737

(1 025)

21 712

21 110

7.7%

2.9%

Operating profit

390

(33)

357

813

(52.0%)

(56.1%)

Net profit from continuing operations

125

(24)

101

477

(73.7%)

(78.9%)

Group share in net profit

105

(24)

81

475

(77.8%)

(82.9%)

Basic earnings from Group share in net

profit

1.05

(0.24)

0.81

4.71

(77.8%)

(82.9%)

Diluted earnings from Group share in net

profit

1.04

(0.24)

0.80

4.68

(77.7%)

(82.8%)

Free cash flow

772

(34)

738

(231)

N/A

N/A

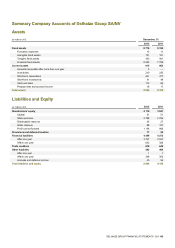

(in millions of €)

December 31, 2012

December 31, 2011

Change

Net debt

2 060

—

2 060

2 647

(22.1%)

(22.2%)

_____________

(1) 2011 was adjusted for the reclassification of the Albanian operations to discontinued operations..

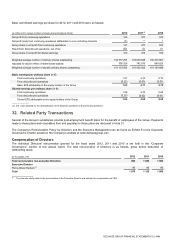

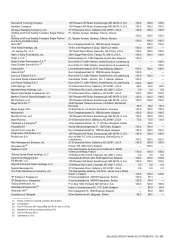

Underlying operating profit reconciliation

December 31, 2012

(in millions of €)

United States

Belgium

Southeastern

Europe and

Asia

Corporate

Total

Operating profit (as reported)

343

202

(113)

(42)

390

Add (substract):

Fixed asset impairment charges (reversals)

63

5

204

—

272

Restructuring expenses (reversals)

—

—

—

—

—

Store closing expenses

109

1

15

—

125

(Gains) losses on disposal of assets

5

7

(1)

1

12

Other

29

(18)

—

—

11

Underling operating profit

549

197

105

(41)

810

2012 was significantly impacted by €272 million impairment charges and the store portfolio optimization expenses: €125 million

store closing expenses and €22 million of related expenses, included in the caption “Other” and mainly consisting of sales price

mark-downs and accelerated depreciation. In addition, the caption “Other” contains storm damage expenses of €5 million, a

retirement expense of €3 million and severance expenses of €6 million, partially compensated by a net gain of €7 million on the

settlement of legal cases in the U.S. and a payroll tax refund (€18 million) in Belgium.

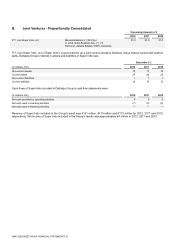

EBITDA reconciliation

(in millions of €)

2012

Operating profit (as reported)

390

Add (substract):

Depreciation and amortization

649

Impairment

272

EBITDA

1 311